|

|

|

|

III. HIGH RISK LENDING:

CASE STUDY OF WASHINGTON MUTUAL BANKC. High Risk Lending Strategy

In 2004, Washington Mutual ramped up high risk home loan originations to borrowers that had not traditionally qualified for them. The following year, Washington Mutual adopted a high risk strategy to issue high risk mortgages, and then mitigate some of that risk by selling or securitizing many of the loans. When housing prices stopped climbing in late 2006, a large number of those risky loans began incurring extraordinary rates of delinquency as did the securities that relied on those loans for cash flow. In 2007, the problems with WaMu's High Risk Lending Strategy worsened, as delinquencies increased, the securitization market dried up, and the bank was unable to find buyers for its high risk loans or related securities.

The formal initiation of WaMu's High Risk Lending Strategy can be dated to January 2005, when a specific proposal was presented to the WaMu Board of Directors for approval. |138| WaMu adopted this strategy because its executives calculated that high risk home loans were more profitable than low risk loans, not only because the bank could charge borrowers higher interest rates and fees, but also because higher risk loans received higher prices when securitized and sold to investors. They garnered higher prices because, due to their higher risk, the securities paid a higher coupon rate than other comparably rated securities.

Over a five-year period from 2003 to 2008, Washington Mutual Bank shifted its loan originations from primarily traditional 30-year fixed and government backed loans to primarily higher risk home loans. This shift included increased subprime loan activity at Long Beach, more subprime loans purchased through its Specialty Mortgage Finance correspondent channel, and more bulk purchases of subprime loans through its conduit channel for use in securitizations. WaMu also increased its originations and acquisitions of Option ARM, Alt A, and home equity loans. While the shift began earlier, the strategic decision to move toward higher risk loans was not fully articulated to regulators or the Board of Directors until the end of 2004 and the beginning of 2005. |139|

In about three years, from 2005 to 2007, WaMu issued hundreds of billions of higher risk loans, including $49 billion in subprime loans |140| and $59 billion in Option ARMs. |141| Data compiled by the Treasury and the FDIC Inspectors General showed that, by the end of 2007, Option ARMs constituted about 47% of all home loans on WaMu's balance sheet and home equity loans made up $63.5 billion or 27% of its home loan portfolio, a 130% increase from 2003. |142| According to an August 2006 internal WaMu presentation on Option ARM credit risk, from 1999 until 2006, Option ARM borrowers selected the minimum monthly payment more than 95% of the time. |143| The data also showed that at the end of 2007, 84% of the total value of the Option ARMs was negatively amortizing, meaning that the borrowers were going into deeper debt rather than paying off their loan balances. |144| In addition, by the end of 2007, stated income loans—loans in which the bank had not verified the borrower's income—represented 73% of WaMu's Option ARMs, 50% of its subprime loans, and 90% of its home equity loans. |145| WaMu also originated numerous loans with high loan-to-value (LTV) ratios, in which the loan amount exceeded 80% of the value of the underlying property. The Treasury and the FDIC Inspectors General determined, for example, that 44% of WaMu's subprime loans and 35% of its home equity loans had LTV ratios in excess of 80%. |146| Still another problem was that WaMu had high geographic concentrations of its home loans in California and Florida, states that ended up suffering above-average home value depreciation. |147|

In 2004, WaMu set the stage for its High Risk Lending Strategy by formally adopting aggressive financial targets for the upcoming five-year time period. The new earnings targets created pressure for the bank to shift from its more conservative practices towards practices that carried more risk. Mr. Killinger described those targets in a June 2004 "Strategic Direction" memorandum to WaMu's Board of Directors: "Our primary financial targets for the next five years will be to achieve an average ROE [Return on Equity] of at least 18%, and average EPS [Earnings Per Share] growth of at least 13%." |148| In his memorandum to the Board, Mr. Killinger predicted continuing growth opportunities for the bank:

"In a consolidating industry, it is appropriate to continually assess if shareholder value creation is best achieved by selling for a short-term change of control premium or to continue to build long-term value as an independent company. We believe remaining an independent company is appropriate at this time because of substantial growth opportunities we see ahead. We are especially encouraged with growth prospects for our consumer banking group. We would also note that our stock is currently trading at a price which we believe is substantially below the intrinsic value of our unique franchise. This makes it even more important to stay focused on building long-term shareholder value, diligently protecting our shareholders from inadequate unsolicited takeover proposals and maintaining our long held position of remaining an independent company." |149|

Mr. Killinger identified residential nonprime and adjustable rate mortgage loans as one of the primary bank businesses driving balance sheet growth. |150| Mr. Killinger also stated in the memorandum: "Wholesale and correspondent will be nationwide and retooled to deliver higher margin products." |151|

After 2002, Washington Mutual stopped acquiring lenders specializing in residential mortgages, |152| and embarked upon a new strategy to push the company's growth, focused on increasing its issuance and purchase of higher risk home loans. OTS took note of this strategy in WaMu's 2004 Report on Examination:

"Management provided us with a copy of the framework for WMI's 5-year (2005-2009) strategic plan [which] contemplates asset growth of at least 10% a year, with assets increasing to near $500 billion by 2009." |153|

OTS directed the bank to spell out its new lending strategy in a written document that had to be presented to and gain approval by the WaMu Board of Directors. |154|

In response, in January 2005, WaMu management developed a document entitled, "Higher Risk Lending Strategy" and presented it to its Board of Directors for approval to shift the bank's focus from originating low risk fixed rate and government backed loans to higher risk subprime, home equity, and Option ARM loans. |155| The Strategy disclosed that WaMu planned to increase both its issuance of higher risk loans and its offering of loans to higher risk borrowers. The explicit reasoning for the shift was the increased profitability of the higher risk loans, measured by actual bank data showing that those loans produced a higher "gain on sale" or profit for the bank compared to lower risk loans. For example, one chart supporting the Strategy showed that selling subprime loans garnered more than eight times the gain on sale as government backed loans. |156|

The WaMu submission to the Board noted that, in order for the plan to be successful, WaMu would need to carefully manage its residential mortgage business as well as its credit risk, meaning the risk that borrowers would not repay the higher risk loans. |157| During the Board's discussion of the strategy, credit officers noted that losses would likely lag by several years. |158| These documents show that WaMu knew that, even if loan losses did not immediately come to pass after initiating the High Risk Lending Strategy, it did not mean the strategy was free of problems.

As part of the 2005 presentation to the Board of Directors outlining the strategy, OTS recommended that WaMu define higher risk lending. |159| The January 2005 presentation contained a slide defining "Higher Risk Lending":

"For the purpose of establishing concentration limits, Higher Risk Lending strategies will be implemented in a ‘phased' approach. Later in 2005 an expanded definition of Higher Risk Lending—encapsulating multiple risk layering and expanded underwriting criteria—and its corresponding concentration limit—will be presented for Board approval.

"The initial definition is ‘Consumer Loans to Higher Risk Borrowers', which at 11/30/04 totaled $32 Billion or 151% of total risk-based capital, comprised of:

-Subprime loans, or all loans originated by Long Beach Mortgage or purchased through our Specialty Mortgage Finance program

-SFR [Single Family Residential] and Consumer Loans to Borrowers with low credit scores at origination." |160|

A footnote on the slide defined "low credit scores" as less than a 620 FICO score for first lien single family residence mortgages, home equity loans, and home equity lines of credit. It defined low credit scores as less than 660 for second lien home equity loans (HEL) and lines of credit (HELOC), and other consumer loans. |161|

While the January 2005 presentation promised to present a fuller definition of higher risk loans for Board approval at some future date, a more complete definition had already been provided to the Board a few weeks earlier in a December 21, 2004 presentation entitled, "Asset Allocation Initiative: Higher Risk Lending Strategy and Increased Credit Risk Management." |162| This presentation contained the same basic definition of higher risk borrowers, but also provided a definition of higher risk loans.

Higher risk loans were defined as single family residence mortgages with a loan-to-value (LTV) ratio of equal to or greater than 90% if not credit enhanced, or a combined-loan-to-value (CLTV) ratio of 95%. These numbers are a notable departure from the 80% LTV ratio traditionally required for a prime loan. |163| For home equity loans and lines of credit, WaMu considered a first lien to be high risk if it had a greater than 90% LTV ratio, and considered a second lien to be high risk if had a greater than 80% CLTV ratio. |164|

The December 2004 presentation also defined higher risk lending on the basis of expanded underwriting criteria and multiple risk layering:

"Expanded Criteria

-‘No Income' loan documentation type

-All Manufactured Housing loans …Multiple Risk Layering in SF[R] and 1st lien HEL/HELOC loans

-Higher A- credit score or lacking LTV as strong compensating factor and

-An additional risk factor from at least three of the following:

-Higher uncertainty about ability to pay or ‘stated income' documentation type

-higher uncertainty about willingness to pay or collateral value" |165|This document indicates that WaMu considered a mortgage to be higher risk if it lacked documentation regarding the borrower's income, described as a "no income" or "stated income" loan.

WaMu held billions of dollars in loans on its balance sheet. |166| Those assets fluctuated in value based on the changes in the interest rate. Fixed rate loans, in particular, incurred significant interest rate risk, because on a 30-year fixed rate mortgage, for example, WaMu agreed to receive interest payments at a certain rate for 30 years, but if the prevailing interest rate went up, WaMu's cost of money increased and the relative value of the fixed mortgages on its balance sheet went down. WaMu used various strategies to hedge its interest rate risk. One way to incur less interest rate risk was for WaMu to hold loans with variable interest rates, such as Hybrid ARMs typical of WaMu's subprime lending, or Option ARMs, WaMu's flagship "prime" product. These adjustable rate mortgages paid interest rates that, after the initial fixed rate period expired, were typically pegged to the Cost of Funds Index (COFI) or the Monthly Treasury Average (MTA), two common measures of prevailing interest rates.

WaMu's internal documents indicate that the primary motivation behind its High Risk Lending Strategy was the superior "gain on sale" profits generated by high risk loans. |167| Washington Mutual management had calculated that higher risk loans were more profitable when sold or securitized. Prior to sale, higher risk loans also produced greater short term profits, because the bank typically charged the borrowers a higher rate of interest and higher fees.

Higher risk home loans placed for sale were more profitable for WaMu, because of the higher price that Wall Street underwriters and investors were willing to pay for them. The profit that WaMu obtained by selling or securitizing a loan was known as the "gain on sale." Gain on sale figures for the loans produced by the bank were analyzed and presented to the WaMu Board of Directors. On April 18, 2006, David Schneider, the President of WaMu Home Loans division, provided the Board of Directors a confidential presentation entitled, "Home Loans Discussion." |168| The third slide in the presentation was entitled, "Home Loans Strategic Positioning," and stated: "Home Loans is accelerating significant business model changes to achieve consistent, long term financial objectives." |169| Beneath this heading the first listed objective was: "Shift from low-margin business to high-margin products," |170| meaning from less profitable to more profitable loan products. The next slide in the presentation was entitled: "Shift to Higher Margin Products," and elaborated on that objective. The slide listed the actual gain on sale obtained by the bank, in 2005, for each type of loan WaMu offered, providing the "basis points" (bps) that each type of loan fetched on Wall Street:

2005 WaMu Gain on Sale

Margin by Product

in bps |171|

Mr. Schneider told the Subcommittee that the numbers listed on the chart were not projections, but the numbers generated from actual, historical loan data. |172| As the chart makes clear, the least profitable loans for WaMu were government backed and fixed rate loans. Those loans were typically purchased by government sponsored enterprises (GSEs) like Fannie Mae, Freddie Mac, and Ginnie Mae which paid relatively low prices for them. Instead of focusing on those low margin loans, WaMu's management looked to make profits elsewhere, and elected to focus on the most profitable loans, which were the Option ARM, home equity, and subprime loans. In 2005, subprime loans, with 150 basis points, were eight times more profitable than a fixed rate loan at 19 basis points and more than 10 times as profitable as government backed loans.

The gain on sale data WaMu collected drove not only WaMu's decision to focus on higher risk home loans, but also how the bank priced those loans for borrowers. In determining how much it would charge for a loan, the bank calculated first what price the loan would obtain on Wall Street. As Mr. Beck explained in his testimony before the Subcommittee:

"Because WaMu's capital markets organization was engaged in the secondary mortgage market, it had ready access to information regarding how the market priced loan products. Therefore my team helped determine the initial prices at which WaMu could offer loans by beginning with the applicable market prices for private or agency-backed mortgage securities and adding the various costs WaMu incurred in the origination, sale, and servicing of home loans." |173|

In 2004, before WaMu implemented its High Risk Lending Strategy, the Chief Risk Officer Jim Vanasek expressed internally concern about the unsustainable rise in housing prices, loosening lending standards, and the possible consequences. On September 2, 2004, just months before the formal presentation of the High Risk Lending Strategy to the Board of Directors, Mr. Vanasek circulated a prescient memorandum to WaMu's mortgage underwriting and appraisal staff, warning of a bubble in housing prices and encouraging tighter underwriting. The memorandum also captured a sense of the turmoil and pressure at WaMu. Under the subject heading, "Perspective," Mr. Vanasek wrote:

"I want to share just a few thoughts with all of you as we begin the month of September. Clearly you have gone through a difficult period of time with all of the changes in the mortgage area of the bank. Staff cuts and recent defections have only added to the stress. Mark Hillis [a Senior Risk Officer] and I are painfully aware of the toll that this has taken on some of you and have felt it is important to tell you that we recognize it has been and continues to be difficult.

"In the midst of all this change and stress, patience is growing thin. We understand that. We also know that loan originators are pushing very hard for deals. But we need to put all of this in perspective.

"At this point in the mortgage cycle with prices having increased far beyond the rate of increase in personal incomes, there clearly comes a time when prices must slow down or perhaps even decline. There have been so many warnings of a Housing Bubble that we all tend now to ignore them because thus far it has not happened. I am not in the business of forecasting, but I have a healthy respect for the underlying data which says ultimately this environment is no longer sustainable. Therefore I would conclude that now is not the time to be pushing appraisal values. If anything we should be a bit more conservative across the board. Kerry Killinger and Bill Longbrake [a Vice Chair of WaMu] have both expressed renewed concern over this issue.

"This is a point where we should be much more careful about exceptions. It is highly questionable as to how strong this economy may be; there is clearly no consensus on Wall Street. If the economy stalls, the combination of low FICOs, high LTVs and inordinate numbers of exceptions will come back to haunt us." |174|

Mr. Vanasek was the senior-most risk officer at WaMu, and had frequent interactions with Mr. Killinger and the Board of Directors. While his concerns may have been heard, they were not heeded.

Mr. Vanasek told the Subcommittee that, because of his predictions of a collapse in the housing market, he earned the derisive nickname "Dr. Doom." |175| But evidence of a housing bubble was overwhelming by 2005. Over the prior ten years, housing prices had skyrocketed in an unprecedented fashion, as the following chart prepared by Paulson & Co. Inc., based on data from the Bureau of Economic Analysis and the Office of Federal Housing Enterprise Oversight, demonstrates. |176|

Mr. Vanasek shared his concerns with Mr. Killinger. At the Subcommittee's hearing, Mr. Killinger testified: "Now, beginning in 2005, 2 years before the financial crisis hit, I was publicly and repeatedly warning of the risks of a potential housing downturn." |177| In March 2005, he engaged in an email exchange with Mr. Vanasek, in which both agreed the United States was in the midst of a housing bubble. On March, 10, 2005, Mr. Vanasek emailed Mr. Killinger about many of the issues facing his risk management team, concluding:

"My group is working as hard as I can reasonably ask any group to work and in several cases they are stretched to the absolute limit. Any words of support and appreciation would be very helpful to the morale of the group. These folks have stepped up to fixing any number of issues this year, many not at all of their own making." |178|

Mr. Killinger replied:

"Thanks Jim. Overall, it appears we are making some good progress. Hopefully, the Regulators will agree that we are making some progress. I suspect the toughest thing for us will be to navigate through a period of high home prices, increased competitive conditions for reduced underwriting standards, and our need to grow the balance sheet. I have never seen such a high risk housing market as market after market thinks they are unique and for whatever reason are not likely to experience price declines. This typically signifies a bubble."

Mr. Vanasek agreed:

"I could not agree more. All the classic signs are there and the likely outcome is probably not great. We would all like to think the air can come out of the balloon slowly but history would not lean you in that direction. Over the next month or so I am going to work hard on what I hope can be a lasting mechanism (legacy) for determining how much risk we can afford to take …."

Despite Mr. Killinger's awareness that housing prices were unsustainable, could drop suddenly, and could make it difficult for borrowers to refinance or sell their homes, Mr. Killinger continued to push forward with WaMu's High Risk Lending Strategy.

WaMu formally adopted the High Risk Lending Strategy in January 2005. |179| Over the following two years, management significantly shifted the bank's loan originations towards riskier loans as called for in the plan, but had to slow down the pace of implementation in the face of worsening market conditions. In retrospect, WaMu executives tried to portray their inability to fully execute the plan as a strategic choice rather than the result of a failed strategy. For example, Mr. Killinger testified at the Subcommittee hearing that the bank's High Risk Lending Strategy was only contemplated, but not really executed:

"First, we had an adjustment in our strategy that started in about 2004 to gradually increase the amount of home equity, subprime, commercial real estate, and multi-family loans that we could hold on the balance sheet. We had that long-term strategy, but … we quickly determined that the housing market was increasing in its risk, and we put most of those strategies for expansion on hold." |180|

Mr. Killinger's claim that the High Risk Lending Strategy was put "on hold" is contradicted, however, by WaMu's SEC filings, its internal documents, and the testimony of other WaMu executives.

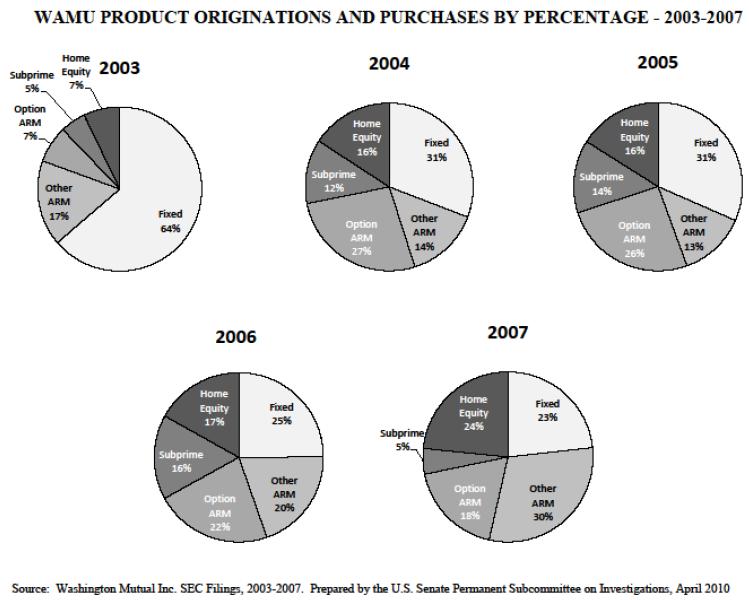

Washington Mutual's SEC filings contain loan origination and acquisition data showing that the bank did implement its High Risk Lending Strategy. Although rising defaults and the 2007 collapse of the subprime secondary market prevented WaMu from fully executing its plans, WaMu dramatically shifted the composition of the loans it originated and purchased, nearly doubling the percentage of higher risk home loans from 36% to 67%. The following chart, prepared by the Subcommittee using data from WaMu's SEC filings, demonstrates the shift. |181|

In 2003, 64% of WaMu's mortgage originations and purchases were fixed rate loans, and only 19% were subprime, Option ARM, or home equity loans. In 2004, 31% of WaMu's mortgage originations and purchases were fixed rate loans, and 55% were subprime, Option ARM, or home equity loans. In 2005, 31% of WaMu's mortgage originations and purchases were fixed rate loans, and 56% were subprime, Option ARM, or equity loans. By 2006, only 25% of WaMu's mortgage originations and purchases were fixed rate loans, and 55% were subprime, Option ARM, or home equity loans. |182| Even after market forces began taking their toll in 2007, and WaMu ended all subprime lending in the fall of that year, its higher risk originations and purchases at 47% were double its fixed rate loans at 23%. |183|

Mr. Killinger's annual "Strategic Direction" memoranda to the Board in 2005, 2006, and 2007, also contradict his testimony that the strategy of expanding high risk lending was put on hold. On the first page of his 2005 memorandum, Mr. Killinger wrote: "We continue to see excellent long-term growth opportunities for our key business lines of retail banking, mortgage banking, multi-family lending and sub-prime residential lending." |184| Rather than hold back on WaMu's stated strategy of risk expansion, Mr. Killinger told the Board that WaMu should accelerate it:

"In order to reduce the impact of interest rate changes on our business, we have accelerated development of Alt-A, government and sub-prime loan products, as well as hybrid ARMs and other prime products, specifically for delivery through retail, wholesale and correspondent channels." |185|

The 2005 strategic direction memorandum also targeted Long Beach for expansion:

"Long Beach is expected to originate $30 billion of loans this year, growing to $36 billion in 2006. To facilitate this growth, we plan to increase account managers by 100. We expect Long Beach to have 5% of the sub-prime market in 2005, growing to [a] 6% share in 2006." |186|

Despite warning against unsustainable housing prices in March 2005, Mr. Killinger's 2006 "Strategic Direction" memorandum to the Board put even more emphasis on growth than the 2005 memorandum. After reviewing the financial targets set in the five-year plan adopted in 2004, Mr. Killinger wrote: "To achieve these targets, we developed aggressive business plans around the themes of growth, productivity, innovation, risk management and people development." |187| His memorandum expressed no hesitation or qualification as to whether the high risk home lending strategy was still operative in 2006. The memorandum stated:

"Finally, our Home Loan Group should complete its repositioning within the next twelve months and it should then be in position to grow its market share of Option ARM, home equity, sub prime and Alt. A loans. We should be able to increase our share of these categories to over 10%." |188|

Contrary to Mr. Killinger's hearing testimony, the 2006 memorandum indicates an expansion of WaMu's high risk home lending, rather than any curtailment:

"We are refining our home loans business model to significantly curtail low margin Government and conventional fixed rate originations and servicing, and to significantly increase our origination and servicing of high margin home equity, Alt. A, sub prime and option ARMs. Action steps include merging Longbeach sub prime and the prime business under common management, merging correspondent activities into our correspondent channel, getting out of Government lending, curtailing conventional fixed rate production, expanding distribution of targeted high margin products through all distribution channels and potentially selling MSRs [Mortgage Servicing Rights] of low margin products. We expect these actions to result in significantly higher profitability and lower volatility over time." |189|

The April 16, 2006 "Home Loans Discussion" presentation by Home Loans President David Schneider, discussed above, also confirms WaMu's ongoing efforts to shift its loan business toward high risk lending. Page four of that presentation, entitled, "Shift to Higher Margin Products," shows two pie charts under the heading, "WaMu Volume by Product." |190| One chart depicts loan volume for 2005, and the second chart depicts projected loan volume for 2008:

WaMu Volume By Product

$ In Billions |191|

These charts demonstrate WaMu's intention to increase its loan originations over three years by almost $30 billion, focusing on increases in high risk loan products. Subprime originations, for example, were expected to grow from $34 billion in 2005 to $70 billion in 2008; Alt A originations were projected to grow from $1 billion in 2005 to $24 billion in 2008; and Home Equity originations were projected to grow from $4 billion in 2005 to $30 billion in 2008. On the other hand, WaMu's low risk originations were expected to be curtailed dramatically. Government backed loan originations, which totaled $8 billion in 2005, were projected to be eliminated by 2008. Fixed rate loan originations were projected to decline from $69 billion in 2005 to $4 billion in 2008.

The 2007 "Strategic Direction" memorandum to the Board is dated June 18, 2007, well after U.S. housing prices had begun to decline, as Mr. Killinger acknowledged:

"For the past two years, we have been predicting the bursting of the housing bubble and the likelihood of a slowing housing market. This scenario has now turned into a reality. Housing prices are declining in many areas of the country and sales are rapidly slowing. This is leading to an increase in delinquencies and loan losses. The sub-prime market was especially rocked as many sub-prime borrowers bought houses at the peak of the cycle and now find their houses are worth less and they are having difficulties refinancing their initial low-rate loans." |192|

While the memorandum's section on home loan strategy no longer focused on overall growth, it continued to push the shift to high risk lending, despite problems in the subprime market:

"Home Loans is a large and important business, but at this point in the cycle, it is unprofitable. The key strategy for 2008 is to execute on the revised strategy adopted in 2006. … We need to optimize the sub-prime and prime distribution channels with particular emphasis on growing the retail banking, home loan center and consumer direct channels. We also expect to portfolio more of Home Loans' originations in 2008, including the new Mortgage Plus product. We will continue to emphasize higher-risk adjusted return products such as home equity, sub-prime first mortgages, Alt A mortgages and proprietary products such as Mortgage Plus." |193|

The testimony of other WaMu executives further confirms the bank's implementation of its High Risk Lending Strategy. Ronald Cathcart, who joined WaMu in 2006, to become the company's Chief Risk Officer, testified:

"The company's strategic plan to shift its portfolios towards higher margin products was already underway when I arrived at WaMu. Basically, this strategy involved moving away from traditional mortgage lending into alternative lending programs involving adjustable-rate mortgages as well as into subprime products. The strategic shift to higher-margin products resulted in the bank taking on a higher degree of credit risk because there was a greater chance that borrowers would default." |194|

Likewise, Steven Rotella, WaMu's President and Chief Operating Officer, who began with the bank in January 2005, testified before the Subcommittee:

"In particular, I want to be very clear on the topic of high-risk lending, this Subcommittee's focus today. High-risk mortgage lending in WaMu's case, primarily Option ARMs and subprime loans through Long Beach Mortgage, a subsidiary of WaMu, were expanded and accelerated at explosive rates starting in the early 2000s, prior to my hiring in 2005…. In 2004 alone, the year before I joined, Option ARMs were up 124 [percent], and subprime lending was up 52 percent." |195|

In his testimony, Mr. Rotella took credit for curtailing WaMu's growth and high risk lending. |196| Mr. Rotella's own emails, however, show that he supported the High Risk Lending Strategy. On October 15, 2005, Mr. Rotella emailed Mr. Killinger about WaMu's 2006 strategic plan: "I think our focus needs to be on organic growth of home eq, and subprime, and greater utilization of [the Home Loans division] as we know it today to facilitate that at lower acquisition costs and greater efficiency." |197|

Mr. Killinger replied by email the next day: "Regarding Longbeach, I think there is a good opportunity to be a low cost provider and gain significant share when the industry implodes." |198| Responding to Mr. Rotella's ideas about the Home Loans division, Mr. Killinger wrote: "It makes sense to leverage the home loans distribution channels with home equity, sub prime, and alt. A." |199| In this late 2005 email exchange, WaMu's two senior-most executives contemplate reducing prime lending, not subprime. Mr. Killinger wrote: "If we can't make a shift in our business model, we might be better off exiting the prime space." |200|

Mr. Rotella replied to Mr. Killinger's email later on October 16, 2005. He continued to emphasize the importance of focusing on high risk lending, referring to his previous experience as a mortgage banker at JPMorgan Chase:

"We did these kinds of analyses all the time at Chase which led us to run as fast as we could into home eq, alt a, subprime (our investment banking brethren stopped us from going too far here). We viewed prime as a source of scale benefits in servicing for the other areas and a conduit of higher margin product and aimed to hold our prime servicing flat to down. I feel strongly that where we need to land is a new home loan unit that includes prime, heq, and subprime. It is a far superior model." |201|

In July 2008, just two months before the collapse of WaMu, Home Loans President David Schneider prepared an internal presentation entitled, "Home Loans Story, External & Internal Views." |202| The presentation was retrospective, providing timelines of WaMu's major strategy, policy, and personnel changes. The first substantive page of the presentation bears the heading, "Three fundamental business shifts occurred in Home Loans this millennium which shaped its performance and position in a volatile competitive landscape":

"2001 to 2005

‘Mono-line' business model focused on generating high volume of low-margin, prime products ….2006

Targeted production franchise toward higher margin products to become a market leader in specific product segments….2007 & Beyond

Subprime mortgage implosion fuels credit and liquidity crisis and the non-agency secondary market disappears[.]"Mr. Scheider's retrospective presentation of the changes that occurred at WaMu is unambiguous: by 2006, WaMu had "targeted production franchise toward higher margin products." |203| According to the same presentation, that model change also lowered earnings volatility for WaMu by lessening exposure to Mortgage Servicing Rights. |204| Later slides provide more detail. A quarterly timeline is presented with the heading: "In an environment of internal and external large-scale change, Home Loans took bold actions to redefine its business into a sustainable model." In the strategy section for the second quarter of 2006, Mr. Schneider wrote: "New business model, high margin products." |205|

Despite warnings by some within its management about the unsustainable housing price bubble, WaMu pursued a High Risk Lending Strategy to generate short term profits from the favorable gain-on-sale margins offered by Wall Street for high risk loans and securitizations, for which the credit rating agencies continued to award AAA ratings. To succeed, the strategy was premised upon borrowers being able to refinance or sell their homes to pay off their loans in the event of a default. Stagnant or declining house prices made refinancing and home sales more difficult.

Effective implementation of the High Risk Lending Strategy also required robust risk management. But while WaMu was incurring significantly more credit risk than it had in the past, risk managers were marginalized, undermined, and subordinated to WaMu's business units. As a result, when credit risk management was most needed, WaMu found itself lacking in effective risk management and oversight.

Notes

138. See 1/2005 "Higher Risk Lending Strategy ‘Asset Allocation Initiative,'" submitted to Washington Mutual Board of Directors Finance Committee Discussion, JPM_WM00302975-93, Hearing Exhibit 4/13-2a. [Back]

139. See, e.g., 12/21/2004 "Asset Allocation Initiative: Higher Risk Lending Strategy and Increased Credit Risk Management," Washington Mutual Board of Directors Discussion, JPM_WM04107995-8008, Hearing Exhibit 4/13- 2b; 1/2005 "Higher Risk Lending Strategy ‘Asset Allocation Initiative,'" submitted to Washington Mutual Board of Directors Finance Committee Discussion, JPM_WM00302975-93, Hearing Exhibit 4/13-2a. [Back]

140. "Securitizations of Washington Mutual Subprime Home Loans," chart prepared by the Subcommittee, Hearing Exhibit 4/13-1c. [Back]

141. 4/2010 IG Report, at 9, Hearing Exhibit 4/16-82. [Back]

143. See 8/2006 Washington Mutual internal report, "Option ARM Credit Risk," chart entitled, "Borrower-Selected Payment Behavior," at 7, Hearing Exhibit 4/13-37. The WaMu report also stated: "Almost all Option ARM borrowers select the minimum payment every month with very high persistency, regardless of changes in the interest rates or payment adjustments." Id. at 2. [Back]

144. 4/2010 IG Report, at 9, Hearing Exhibit 4/16-82. [Back]

148. 6/1/2004 Washington Mutual memorandum from Kerry Killinger to the Board of Directors, "Strategic Direction," JPM_WM05385579 at 581. [Back]

152. The only new lender that Washington Mutual acquired after 2004 was Commercial Capital Bancorp in 2006. [Back]

153. See 3/15/2004 OTS Report of Examination, at OTSWMS04-0000001509, Hearing Exhibit 4/16-94 [Sealed Exhibit]. [Back]

154. 6/30/2004 OTS Memo to Lawrence Carter from Zalka Ancely, OTSWME04-0000005357 at 61 ("Joint Memo #9 - Subprime Lending Strategy"); 3/15/2004 OTS Report of Examination, at OTSWMS04-0000001483, Hearing Exhibit 4/16-94 [Sealed Exhibit]. See also 1/2005 "Higher Risk Lending Strategy Presentation," submitted to Washington Mutual Board of Directors, at JPM_WM00302978, Hearing Exhibit 4/13-2a ("As we implement our Strategic Plan, we need to address OTS/FDIC 2004 Safety and Soundness Exam Joint Memos 8 & 9 . . . Joint Memo 9: Develop and present a SubPrime/Higher Risk Lending Strategy to the Board."). [Back]

155. 1/2005 "Higher Risk Lending Strategy Presentation," submitted to Washington Mutual Board of Directors, at JPM_WM00302978, Hearing Exhibit 4/13-2a; see also 4/2010 "WaMu Product Originations and Purchases by Percentage – 2003-2007," chart prepared by the Subcommittee, Hearing Exhibit 4/13-1i. [Back]

156. 4/18/2006 Washington Mutual Home Loans Discussion Board of Directors Meeting, at JPM_WM00690894, Hearing Exhibit 4/13-3 (see chart showing gain on sale for government loans was 13; for 30-year, fixed rate loans was 19; for option loans was 109; for home equity loans was 113; and for subprime loans was 150.). [Back]

157. See 4/18/2006 Washington Mutual Home Loans Discussion Board of Directors Meeting, at JPM_WM00690899, Hearing Exhibit 4/13-3 (acknowledging that the risks of the High Risk Lending Strategy included managing credit risk, implementing lending technology and enacting organizational changes). [Back]

158. 1/18/2005 Washington Mutual Inc. Washington Mutual Bank FA Finance Committee Minutes, JPM_WM06293964; see also 1/2005 "Higher Risk Lending Strategy Presentation," submitted to Washington Mutual Board of Directors, at JPM_WM00302987, Hearing Exhibit 4/13-2a ("Lags in Effects of Expansion," chart showing peak loss rates in 2007). [Back]

159. 6/30/2004 OTS Memo to Lawrence Carter from Zalka Ancely ("Joint Memo #8 - Loans to ‘Higher-Risk Borrowers'"), OTSWME04-0000005357 at 61. [Back]

160. 1/2005 "Higher Risk Lending Strategy Presentation," submitted to Washington Mutual Board of Directors, at JPM_WM00302979, Hearing Exhibit 4/13-2a. [Back]

161. Id. at JPM_WM00302979. [Back]

162. 12/21/2004 "Asset Allocation Initiative: Higher Risk Lending Strategy and Increased Credit Risk Management," Washington Mutual Board of Directors Presentation, at JPM_WM04107995-8008, Hearing Exhibit 4/13-2b. [Back]

163. See, e.g., 10/8/1999 "Interagency Guidance on High LTV Residential Real Estate Lending," http://www.federalreserve.gov/boarddocs/srletters/1993/SR9301.htm, and discussion of high LTV loans in section D(2)(b), below. [Back]

164. 12/21/2004 "Asset Allocation Initiative: Higher Risk Lending Strategy and Increased Credit Risk Management," Washington Mutual Board of Directors Presentation, JPM_WM04107995-8008 at 7999, Hearing Exhibit 4/13-2b. [Back]

165. Id. This slide lists only the two additional risk factors quoted, despite referring to "at least three of the following." [Back]

166. See 9/25/2008 "OTS Fact Sheet on Washington Mutual Bank," Dochow_Darrel-00076154_001 ("Loans held: $118.9 billion in single-family loans held for investment - this includes $52.9 billion in payment option ARMs and $16.05 billion in subprime mortgage loans"). [Back]

167. 1/18/2005 Washington Mutual Inc. Washington Mutual Bank FA Finance Committee Minutes at JPM_WM06293964; see also 1/2005 "Higher Risk Lending Strategy Presentation," submitted to Washington Mutual Board of Directors, at JPM_WM00302977, Hearing Exhibit 4/13-2a [Back]

168. 4/18/2006 "Home Loans Discussion Board of Directors Meeting," WaMu presentation, JPM_WM00690890-901, Hearing Exhibit 4/13-3. [Back]

169. Id. at 893 [emphasis in original removed]. [Back]

171. Id. at 894 [formatting as in the original]. [Back]

172. Subcommittee interview of David Schneider (2/16/2010). [Back]

173. April 13, 2010 Subcommittee Hearing at 53. [Back]

174. 9/2/2004 Washington Mutual memorandum from Jim Vanasek, "Perspective," Hearing Exhibit 4/13-78b. [Back]

175. Subcommittee interview of Jim Vanasek (12/18/2009). [Back]

176. "Estimation of Housing Bubble," PSI-Paulson&Co-02-00003, Hearing Exhibit 4/13-1j. [Back]

177. April 13, 2010 Subcommittee Hearing at 85. [Back]

178. 3/2005 WaMu internal email chain, Hearing Exhibit 4/13-78. [Back]

179. See 3/13/2006 OTS Report of Examination, at OTSWMS06-008 0001677, Hearing Exhibit 4/16-94 [Sealed Exhibit]. [Back]

180. April 13, 2010 Subcommittee Hearing at 88. [Back]

181. 4/2010 "WaMu Product Originations and Purchases by Percentage – 2003-2007," chart prepared by the Subcommittee, Hearing Exhibit 4/13-1i. [Back]

184. 6/1/2005 Washington Mutual memorandum from Kerry Killinger to the Board of Directors, "Strategic Direction," JPMC/WM - 0636-49 at 36, Hearing Exhibit 4/13-6c. [Back]

187. 6/6/2006 Washington Mutual memorandum from Kerry Killinger to the Board of Directors, "Strategic Direction," JPM_00808312-324 at 314, Hearing Exhibit 4/13-6d. [Back]

188. Id. at 315 [emphasis in original removed]. [Back]

190. 4/18/2006 "Home Loans Discussion Board of Directors Meeting," WaMu PowerPoint presentation, JPM_WM00690890-901 at 894, Hearing Exhibit 4/13-3. [Back]

191. Id. [formatted for clarity]. [Back]

192. 6/18/2007 Washington Mutual memorandum from Kerry Killinger to the Board of Directors, "Strategic Direction," JPM_WM03227058-67 at 60, Hearing Exhibit 4/13-6a. [Back]

193. Id. at 66 [emphasis in original removed]. See also 1/2007 Washington Mutual presentation, "Subprime Mortgage Program," JPM_WM02551400, Hearing Exhibit 4/13-5 (informing potential investors in its subprime RMBS securities that: "WaMu is focusing on higher margin products"). [Back]

194. April 13, 2010 Subcommittee Hearing at 18-19. [Back]

196. See id., e.g., at 83-84. [Back]

197. 10/15/2005-10/16/2005 email from Steve Rotella to Kerry Killinger, JPM_WM00665373-75. [Back]

198. Id. at JPM_WM00665374. [Back]

201. Id. at JPM_WM00665373. [Back]

202. 7/2008 "Home Loans Story, External & Internal Views," Washington Mutual PowerPoint presentation, Hearing Exhibit 4/13-80. [Back]

Back to Contents B. Background D. Shoddy Lending Practices

This document has been published on 08Jul11 by the Equipo Nizkor and Derechos Human Rights. In accordance with Title 17 U.S.C. Section 107, this material is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes.