| Information |  | |

Derechos | Equipo Nizkor

| ||

| Information |  | |

Derechos | Equipo Nizkor

| ||

29Apr13

U.S. International Investment Agreements: Issues for Congress

Contents

International Rules for Investment

What Are Investment Agreements?Post-World War II Emergence of BITs and Recent Trends

Increased FDI Flows

Growing Number of Investment Dispute CasesGoals and Basic Provisions

The 2004 Model BIT

The 2012 Model BITU.S. Investment Agreements and Negotiations

BITs

FTAsDo U.S. BITs Promote Investment Abroad?

Negotiating Priorities for the U.S. Investment Policy AgendaFigures

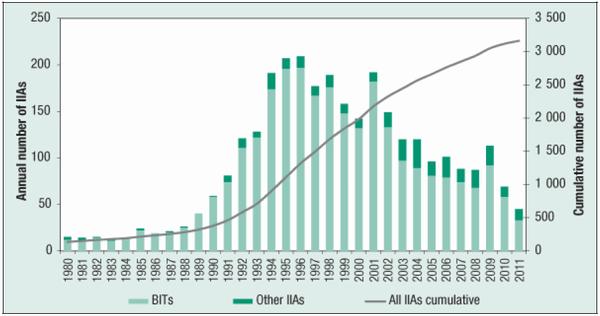

Figure 1. Number of New Investment Agreements, 1980-2011

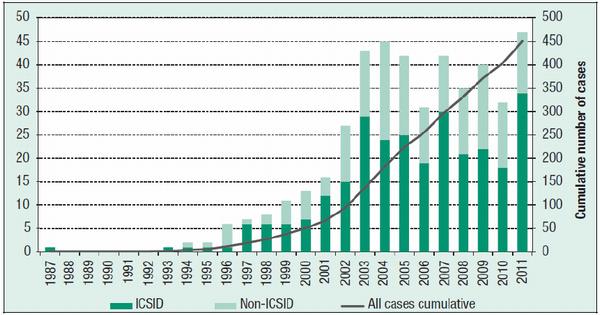

Figure 2. Number of Investor-State Dispute Cases, 1987-2011Tables

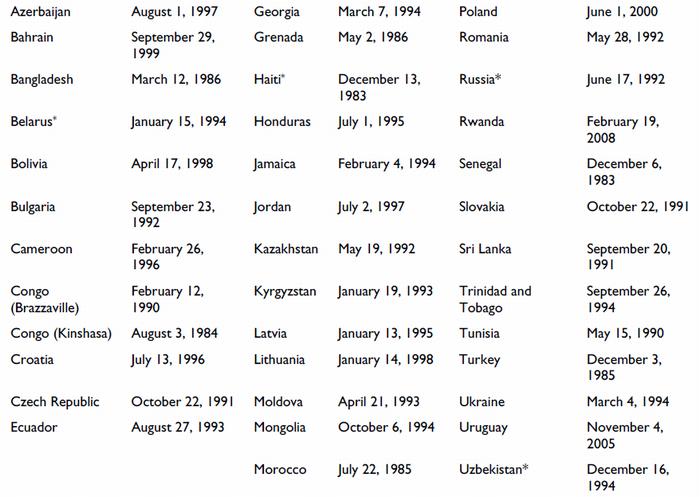

Table 1. United States Bilateral Investment Treaties

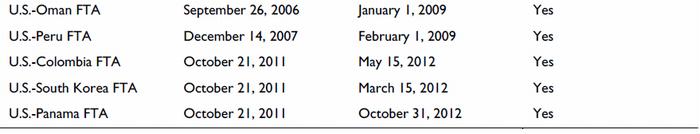

Table 2. U.S. Free Trade Agreements (FTAs) in Effect: Investment Provisions

Summary

Foreign direct investment (FDI) is an increasingly important driver of the global economy. In the absence of an overarching multilateral framework on investment, bilateral investment treaties (BITs) and investment chapters in free trade agreements (FTAs), collectively referred to as "international investment agreements," have emerged as the primary mechanism for promoting a rules-based system for international investment. These agreements contain provisions on nondiscriminatory treatment of investments by the host country, limits on expropriation of investments, and access to impartial binding procedures to settle investment-related disputes with host governments, among other things. FTA investment chapters generally contain provisions identical or similar to those in U.S. BITs.

As FDI flows have expanded, the number of international investment agreements also has increased, both between developed and developing countries and between developing countries. Presently, there are over 3,000 BITs globally. The United States has concluded 47 BITs, 41 of which have entered into force. Of the 14 FTAs agreed by the United States, 12 contain investment provisions. Investment dynamics also have given rise to more investment disputes. In 2011, the number of investment disputes filed in international arbitration forums was 47, its highest level ever for a single year. Congress plays an active role in developing and implementing U.S. policy on FDI through its oversight and legislative responsibilities. Congress can set investment negotiating objectives for U.S. trade agreements in trade promotion authority (TPA). Unlike FTAs, which require a full vote of Congress on implementing legislation, BITs, as international treaties, require only Senate ratification.

The United States, which remains both a major source for and a major destination of FDI, uses international investment agreements to reduce restrictions on foreign investment, provide non-discriminatory treatment for foreign investment, and reduce other market-distorting measures to maximize the benefits of such investment, while balancing other U.S. policy interests. In April 2012, the Obama Administration announced the conclusion of its review of the U.S. Model BIT, the template which the United States uses to negotiate BITs and investment chapters in FTAs. The 2012 Model BIT maintains the "core" or substantive investor protections affirmed in the 2004 Model BIT. It also clarifies that BIT obligations apply to state-owned enterprises (SOEs); limits performance requirements; strengthens labor and environmental provisions; clarifies which financial services provisions may fall under a prudential exception (such as to address balance of payments problems); expands transparency obligations; and increases requirements for stakeholder input in the standards-setting process.

The conclusion of the Model BIT review may generate momentum to conclude previously launched negotiations with countries such as China and India, or to launch investment negotiations with other U.S. trading partners. Investment policy issues feature prominently in other ongoing U.S. trade negotiations, including the proposed Trans-Pacific Partnership (TPP) FTA, as well as the anticipated Transatlantic Trade and Investment Partnership (TTIP) negotiation. In addition to considering negotiating priorities for these and proposed BITs with major emerging economies, Members may also want to consider the effectiveness of BITs in promoting and protecting investment.

The global landscape for foreign direct investment (FDI) is undergoing significant transformation. |1| Over the past few decades, investment flows have increased with greater economic integration of the global economy and the growth of international value chains. Although global FDI flows dipped amid the 2008 international financial crisis, they surpassed pre-crisis levels in 2011. |2| Previous distinctions between advanced country/capital exporters and developing country/capital importers are being blurred as more and more countries are both sources of and hosts for FDI.

The United States, which remains a major source of and destination for FDI, seeks to facilitate investment flows by reducing restrictions on foreign investment and enhancing protections for investors, while balancing other policy interests. In 2011, the Obama Administration issued a statement reaffirming the United States' commitment to an open investment policy that treats all investors in a fair and equitable manner under the law, and encourages and supports business investment from both domestic and foreign sources. |3|

The primary policy tools through which the United States advances its investment policy interests are bilateral investment treaties (BITs) and BIT-like chapters in free trade agreements (FTAs)-- collectively referred to as "international investment agreements." The United States negotiates investment agreements to provide non-discriminatory treatment to private investment, help facilitate market-oriented policies in partner countries, and promote U.S. exports, among other goals. |4| Congress plays an important role in shaping U.S. investment policy through its oversight and legislative responsibilities. For example, Congress can set trade policy negotiating objectives on investment in trade promotion authority (TPA). |5| As international treaties, U.S. BITs require the advice and consent of two-thirds of the Senate in order to be ratified for implementation. U.S. FTAs, which generally include investment chapters, require enactment of implementing legislation by both the House of Representatives and the Senate.

This report provides an overview of U.S. international investment agreements, focusing specifically on BITs and investment chapters in FTAs. It discusses key trends in U.S. and international investment flows, governance structures for investment at the bilateral and multilateral levels, the goals and basic components of investment provisions in U.S. international investment agreements, the outcomes of the Administration's Model BIT review, and key policy issues for Congress. |6|

International Rules for Investment

In contrast to other areas of policymaking such as international trade, there is no comprehensive agreement on international rules for the promotion and protection of investment. Over the past several decades, efforts have been made through international organizations to develop investment rules. |7|

The last major effort was through the Organization for Economic Cooperation and Development (OECD). During the 1990s, developed countries in the OECD proposed a Multilateral Agreement on Investment (MAI), which would have included provisions to liberalize and provide non-discriminatory treatment for investment and provide a dispute settlement mechanism. |8| The OECD negotiations ultimately were abandoned following policy disagreements among participating countries, the business community, and nongovernmental organizations. |9|

Although no comprehensive multilateral investment agreement has been negotiated, there are several multilateral agreements on investment that are limited in scope. The Energy Charter Treaty, agreed to in 1994, covers investment in the energy sector among its 51 member countries (the United States is not a member). Investment issues are also partly addressed in several World Trade Organization (WTO) agreements:

- The Trade-Related Investment Measures (TRIMS) Agreement prevents WTO member countries from applying restrictive investment measures that are inconsistent with national treatment obligations (such as performance requirements) under the General Agreement on Tariffs and Trade (GATT);

- The General Agreement on Trade in Services (GATS) includes investment liberalization provisions related to trade in services; and

- The Agreement on Subsidies and Countervailing Measures (ASCM) and the Government Procurement Agreement (GPA) deal indirectly with investment by including several investment incentives in its definition of subsidies and public procurement services, respectively. |10|

Some WTO members sought to include investment in the Doha Round of WTO trade negotiations. The 2001 WTO Doha Declaration directed the WTO Working Group on the Relationship between Trade and Investment to focus on several investment issues. However, widespread opposition to the inclusion of investment issues (as well as trade and competition and procurement) in the negotiations led to their omission from the WTO agenda at the 2003 WTO Ministerial Conference in Singapore. In addition, investment is covered by several so-called "soft law" (non-binding) efforts such as the OECD's Guidelines for Multinational Enterprises and the OECD's Code of Capital Movements.

What Are Investment Agreements?

In the absence of an overarching multilateral framework on investment, investment flows largely are governed by bilateral and regional investment treaties agreed upon mutually acceptable terms. Over the past several decades, BITS (along with investment chapters in FTAs) have emerged as the primary source of international investment law and the primary mechanisms for promoting and protecting global direct investment flows.

BITs and FTA investment chapters are binding reciprocal agreements that promote and protect investors of one state (home) in the territory of another (host) by establishing a number of basic protections. The provisions of BITs are generally similar across countries. They are a combination of the substantive obligations for the home and host countries and provisions allowing for investor-state dispute resolution. The former typically include national treatment and most-favored nation (MFN) treatment of foreign investors in the host country, |11| the right to transfer profits in hard currency to the home country, prohibition on the use of performance requirements, |12| and the right to compensation for direct and indirect expropriation. |13|

For advanced economies, the primary rationale for signing a BIT is investment protection. Investment promotion is a secondary priority. Developing countries, on the other hand, conclude BITs primarily to promote inward FDI and signal to foreign investors that they will protect foreign property rights. There is a concern that many developing countries, where the quality of domestic institutions may be weak, may promise to protect foreign investors prior to an investment, only to change various terms (such as raising taxes, introducing various export quotas, or expropriation of assets) following the investment. Some analysts raise concerns that when BITs are a substitute for local legal institutions, rather than improve host country governance, their presence may lead to reductions in the quality of local institutions. |14| Others argue that BITs serve as a model to improve local institutions and the rule of law.

Post-World War II Emergence of BITs and Recent Trends

The failure to reach a comprehensive, multilateral agreement on investment protection and liberalization was a source of concern in the post-war economy. According to one analyst,

In the period after World War II, as foreign investment gained momentum as an increasingly important international economic activity, foreign investors who sought the protection of international investment law encountered an ephemeral structure consisting largely of scattered treaty provisions, a few questionable customs, and contested general principles of law. |15|

Beginning in 1959, European countries, especially those lacking colonial ties and informal networks in developing countries, started negotiating investment treaties to safeguard their existing global investments and facilitate new investments. The first two BITs were signed by Germany in 1959 with Pakistan and the Dominican Republic, respectively. Switzerland signed an agreement with Tunisia in 1961. Early BITs allowed for direct state-to-state resolution of investment disputes. This changed in 1966 with the creation of the International Centre for the Settlement of Investment Disputes (ICSID). An affiliate organization of the World Bank, ICSID provides arbitration facilities for aggrieved investors to directly bring claims against a foreign government.

By the mid-1960s, several European countries including France, the Netherlands, Denmark, and Norway had initiated BIT programs. Asian nations began to sign BITs in the 1970s; Japan signed its first BIT in 1977 with Egypt. They were followed by the United States, which initiated its BIT program in 1977. Following the fall of the Soviet Union, Central and Eastern European countries began signing BITs in the late 1980s and 1990s, and Latin American countries entered the arena in the 1990s.

The BIT network grew slowly over the first three decades. In the beginning, BITs were drafted by capital-exporting states with the primary purpose of protecting their investors from unfair foreign treatment. For developing countries, there was a shared belief that BITs would increase foreign investment spurring economic growth. By the end of the 1980s, 385 BITs had been signed. |16| From the late 1980s through the mid-1990s, BITs proliferated rapidly, both between developed and developing countries and between developing countries, as many developing countries embraced the so-called "Washington Consensus" reforms of macroeconomic discipline, market-based economies, and openness to trade and foreign direct investment (Figure 1). By the end of 2011, 2,833 BITs had been concluded throughout the world. Adding FTAs with investment provisions, economic partnership agreements and regional agreements, the total now exceeds 3,000. |17|

Figure 1. Number of New Investment Agreements, 1980-2011

Source: United Nations Conference on Trade and Development (UNCTAD), 2012 World Investment Report.

Note: The term "IIA" refers to international investment agreements.The increase in the number of BITs worldwide is largely a consequence of the rapid growth of FDI in recent decades. FDI, capital flows between nations for the purpose of acquiring lasting interest in enterprises operating outside of the economy of the investor, more than tripled between 1995 and 2011 (Figure 2). According to the United Nations Conference on Trade and Development (UNCTAD), global FDI declined by 18% in 2012 to an estimated $1.3 trillion from $1.5 trillion in 2011. FDI had recovered significantly in 2010 and 2011, and despite the decline remains especially strong in developing economies.

Over the past decade, developing and transitioning economies have become an increasingly attractive destination for FDI and, since 2010, account for a majority of global FDI inflows. According to recent UNCTAD figures, FDI flows to developing countries exceeded those to developed countries for the first time in 2012, by $130 billion. |18| Another significant trend over the past decade has been a decline in outward FDI from advanced economies and an increase in FDI from developing countries. This trend has been especially driven by the need for gas, oil, and other natural resources in China and other rapidly growing emerging markets.

Growing Number of Investment Dispute Cases

As discussed above, a core component of the international investment regime is procedures for neutral investor-state dispute resolution, which allow investors to bring claims against a foreign government instead of requiring their government to espouse the claim on the investor's behalf.

The most widely used forums for investor-state arbitration is the World Bank-affiliate ICSID and the United Nations Commission on International Trade Law (UNCITRAL) (see text box). Although rarely used, many BITs, including those of the United States, also provide for state-state arbitration.

With the rise in investment flows over the past two decades there has also been an increase in investment disputes. Despite the inclusion in BITs of investor-state dispute resolution provisions since 1968, it was not until the mid-1990s, following the passage of several investment agreements between advanced economies, that the number of cases of investment disputes began increasing. In 2011, the number of known treaty-based investment disputes filed under international arbitration, at 47, was the highest level for a single year (Figure 2).

Figure 2. Number of Investor-State Dispute Cases, 1987-2011

Source: UNCTAD, 2012 World Investment Report.

Note: Data show where cases were filed.

Mechanisms for Investor-State Dispute Resolution The majority of international investor disputes, as illustrated by Figure 2, are conducted by under rules established by the 1965 Convention on the Settlement of Investment Disputes between States and Nationals of Other States, which established the International Centre for Settlement of Investment Disputes (ICSID). ICSID is an affiliate of the World Bank Group, headquartered in Washington, D.C., and provides arbitral services and rules for investment disputes to the 147 members who have ratified the ICSID Convention. A separate facility, the ICSID Additional Facility, was created in 1978 to arbitrate disputes if either the home or host state, but not both, are members of ICSID. The ICSID Additional Facility can also arbitrate non-investment disputes.

The most common alternative to ICSID is international arbitration under rules and mechanisms established in the United Nations Commission on International Trade Law (UNCITRAL), the leading ad-hoc set of arbitration rules. Unlike ICSID, UNCITRAL rules not provide an institution to administer the arbitration and all aspects of the dispute resolution (tribunal, support staff, facilities, etc.) are developed ad-hoc. Other arbitration rules include those of the International Chamber of Commerce, the Stockholm Chamber of Commerce, and the Permanent Court of Arbitration.

There has also been expansion of the scope of investment disputes. In recent years, claims have challenged the impact of policies such as environmental and labor regulations, emergency economic measures related to the 2008 economic crisis, and cultural protection laws, among others. |19| For example:

- In November 2011, Philip-Morris filed an investment treaty claim against Australia after the passage of its Tobacco Plain Packaging Act, an effort to reduce the appeal of tobacco products by forbidding the use of graphics, symbols, or images in their packaging and marketing. Philip Morris, through its Hong Kong subsidiary, argues that the Act is a violation of the Australia-Hong Kong BIT and is seeking suspension of the legislation's enforcement or compensatory damages of several billion Australian dollars. Australia's opposition to the inclusion of investor-state arbitration in the proposed Trans-Pacific Partnership (TPP) FTA derives in part from this case. |20|

- In June 2012, Vattenfall, a Swedish Energy Company, filed an investment treaty claim against Germany after the German government initiated a phase-out of nuclear power following the Japanese tsunami and Fukushima nuclear disaster. Vattenfall is arguing that the impact of new German environmental regulations are in violation of Germany's commitments as a signatory to the Energy Charter Treaty |21|; and

- In December 2012, Repsol, a Spanish oil firm, filed a complaint against the government of Argentina after its expropriation of Repsol's 51% controlling stake in YPF, Argentina's largest energy company, which Repsol values at $10 billion. |22|

The United States has faced over twenty investment claims related to North American Free Trade Agreement alone, and has won all three cases that were decided by an independent arbitration panel. A prominent case that the United States won involved Metalclad, a U.S. firm that acquired a Mexican company to build and operate a waste plant and landfill in Mexico. After local authorities denied Metalclad a construction permit, a claim was filed and arbitrators awarded $16.7 million on a finding that denial of a construction permit, which was done on environmental grounds, constituted an expropriation of Metalclad's investment. |23|

In response to these cases, the United States and other countries have clarified the objectives for their investment programs and re-evaluated the balance of rights for investors and other economic and non-economic policy priorities (environment, labor, social welfare, etc.) provided in their future investment agreements. These issues are discussed below.

Following European success with BITs in the 1960s, the United States established its BIT program in 1977. The program is jointly administered by the Department of State and the United States Trade Representative (USTR). The United States uses a "Model BIT" to negotiate BITs and investment chapters of FTAs. The United States completed its original model text in 1981, and its first BIT was in 1982 with Panama. The U.S. Model BIT has been revised several times, most recently in 2004 and 2012.

Although U.S. BITs differ slightly among themselves, they broadly provide five basic benefits:

- The better of national treatment (i.e., non-discrimination) or most-favored-nation treatment for the full life cycle of investment (from its establishment or acquisition, through its management, operation and expansion, to its disposition);

- Clear limits on the expropriation of investments and provisions for payment of prompt, adequate, and effective compensation when direct and indirect expropriation takes place;

- Quick transfer of funds into and out of the host country without delay using a market rate of exchange;

- Restrictions on trade-distorting performance requirements (such as local content rules or export quotas); and

- The right of an investor to submit an investment dispute with the treaty partner's government to international arbitration.

Many BITs, including those of the United States, include a national security and prudential "escape clause." For example, Article 18 of the U.S.-Uruguay BIT states that each party to the treaty has the right to restrict "access to any information the disclosure of which it determines to be contrary to its essential security interests" and to apply measures "that it considers necessary for the fulfillment of its obligations with respect to the maintenance or restoration of international peace or security, or the protection of its own essential security interests." |24|

Prior to the 2004 changes, the United States negotiated BITs on a 1994 Model BIT based largely on the investment chapter in the North American Free Trade Agreement (NAFTA). Chapter 11 of NAFTA codified the main elements of U.S. BITs, including national treatment, most-favored-nation status, fair and equitable treatment, restrictions on performance requirements, and binding international dispute arbitration. |25|

The 2004 Model BIT changes largely related to U.S. concerns that the types of protection granted to foreign investors by NAFTA may have been written too broadly, and that foreign investors would possibly receive more favorable treatment for their NAFTA-related investor-state dispute claims than U.S. investors would under U.S. law. Congress addressed these concerns by mandating negotiating objectives in the Trade Act of 2002 (P.L. 107-210) to clarify the scope of investment protection. The Act stated that the principal U.S. negotiating objective on foreign investment was to reduce or eliminate barriers to investment, "while ensuring that foreign investors in the United States are not accorded greater substantive rights with respect to investment protections than United States investors in the United States, and to secure for investors important rights comparable to those that would be available under United States legal principles and practice." |26|

Incorporating congressional objectives, the 2004 Model BIT contains several additions, including a narrower definition of investment covered under the agreement, a narrower minimum standard of treatment, more detailed provisions on investor-state dispute settlement, and provisions to enhance the transparency of national laws and proceedings, as well as preambular language addressing environmental and labor standards. |27|

The Department of State's Advisory Committee on International Economic Policy (ACIEP) released a report in March 2004 that summarized many of the diverging views on the BIT program and the new Model BIT. In general, the U.S. business community opposed changes that might weaken investor protections. Environmental non-governmental organizations (NGOs) and labor groups, on the other hand, raised concerns that it did not go far enough in protecting host governments' regulatory authority. |28|

The draft Model BIT was introduced in November 2004 and was used as the basis for the U.S. BITs with Uruguay and Rwanda.

Although the United States has never lost an investment dispute brought against it, the fact that the United States is increasingly exposed to potential disputes has made successive U.S. administrations more cautious about extending treaty-based investor protections to foreigners. |29|

Not long after taking office, the Obama Administration suspended several ongoing BIT negotiations and began an effort to review the scale and scope of investor protections it sought for U.S. investors and would offer foreign investors in the United States. The Administration conducted the review to ensure that the Model BIT "was consistent with the public interest and the Administration's overall economic agenda," as well as to address issues raised by global economic developments since the last Model BIT review, including the international financial crisis and the growth of state-owned enterprises (SOEs). |30|

As part of the review, the Administration sought and received input from Congress and a range of U.S. stakeholders, including companies, industry associations, labor, environmental and other NGOs, and academics. In September 2009, an ACIEP subcommittee offered recommendations and observations on the Model BIT to the Administration, reaching similar conclusions to those in the 2004 ACIEP meetings that reflected a diversity of stakeholder views. |31|

In April 2012, the Obama Administration announced the conclusion of its three-year review of the U.S. Model BIT. |32| The 2012 Model BIT upholds the substantive investor protections provided by the 2004 Model BIT. Changes in the 2012 U.S. Model BIT were relatively modest, but may prove significant by providing greater recognition of labor and environmental issues, policy issues that are central to ongoing BIT negotiations with China and other developing countries with state-led economies. In addition to U.S. BITs, the investment language in the 2012 model BIT forms the baseline for the ongoing Trans-Pacific Partnership negotiations and a possible FTA between the United States and the European Union.

U.S. government officials rejected efforts by critics to require investors to exhaust domestic efforts before using investor-state arbitration or to replace investor-state arbitration with only state-state dispute resolution.

The 2012 Model BIT includes changes in the following areas:

- State-owned enterprises. The 2012 Model BIT clarifies that BIT obligations apply to SOEs by defining (in a footnote in Article 2) "the standard for whether a Party has delegated governmental authority to an SOE or any other person or entity." SOEs often have special privileges, such as access to preferential financing from their governments, or certain immunities that may not be available to foreign investors.

- Performance requirements. The 2012 Model BIT contains new provisions prohibiting a Party from requiring investors to "purchase, use, or accord a preference to, in its territory" domestically developed technology to provide an advantage to a Party's own investors, investments, or technology (Article 8).

- Environment and labor interests. The 2012 Model BIT expands obligations on standards related to the environment (Article 12) and labor (Article 13). It requires Parties to not "waive or derogate" from, and not to fail to effectively enforce, their domestic environment and labor laws in order to encourage investment. It also requires Parties to recognize the importance of their respective environmental laws and multilateral agreements and to reaffirm their commitments under the International Labor Organization. In addition, it provides for more extensive consultation procedures on matters related to environmental and labor standards.

- Financial services. The 2012 Model BIT clarifies which financial services provisions may fall under a prudential exception, such as to address balance of payments problems (Article 20).

- Transparency. The 2012 Model BIT strengthens transparency obligations by requiring the Parties to consult periodically on ways to improve their transparency practices "in the context of developing and implementing" laws, regulations, standards, and other measures affecting investment, as well as on investor-state dispute settlement (Article 11).

- Standards. The 2012 Model BIT requires Parties to allow investors of the other Party to participate in the development of standards and technical regulations on nondiscriminatory terms. Further language recommends that nongovernmental standardizing bodies in the territory of the Parties also observe this requirement (Article 11).

- Dispute resolution. The 2012 Model BIT enhances language regarding the possibility of a future multilateral appellate mechanism, which could review awards rendered by investment arbitration tribunals, along with the requirement that Parties strive to ensure that any such appellate mechanism includes provisions on transparency and public participation comparable to those already provided for in investor-state dispute settlement under the Model BIT (Article 28).

Congressional and stakeholder reactions to the 2012 Model BIT have been mixed. There is debate about whether the 2012 Model BIT strikes an appropriate balance between protecting investors and enabling regulatory authorities to protect the public interest. |33|

It remains to be seen how the changes in the U.S. Model BIT may affect the negotiation of BITs with China, India, Pakistan, and potentially other major emerging economies such as Brazil. Although differences remain on many issues (national treatment, for example), the interests of the United States and emerging economies as regards to investment protection appear to be converging more than in the past, as both advanced and developing countries must now address a similar range of issues as both hosts and sources of foreign investment.

U.S. Investment Agreements and Negotiations

As both a major source of and destination for FDI, the United States has engaged in negotiations through BITs and FTAs to remove restrictions on foreign investment and other market-distorting measures to maximize the benefits of such investment and provide for reciprocal nondiscriminatory treatment for U.S. investors. What follows is a discussion of existing U.S. investment agreements and current U.S. investment negotiations.

Since 1982, the United States has concluded 47 BITs, 41 of which have entered into force (see Table 1). Most recently, the U.S.-Rwanda BIT entered into force on January 1, 2012; the treaty was signed on February 19, 2008.

Current U.S. BIT negotiations are focused largely on rising economic powers, many of which present significant commercial opportunity to U.S. businesses, as well as significant investment barriers. |34| With the 2012 Model BIT in place, the United States is resuming previously launched BIT negotiations with several countries, including China, India, Pakistan, and Mauritius. |35| Revisions to the Model BIT, such as in the areas of SOEs, the transfer of technology, and transparency, may be highly relevant to negotiations with emerging economies in addressing challenges faced by U.S. businesses. In addition, the United States is working with the East African Community (EAC) on a regional investment treaty as part of a new trade and investment partnership between the United States and the EAC. |36| The United States also may launch new BIT negotiations with countries. For example, in April 2012, Secretary of State Clinton expressed support for launching BIT negotiations with Brazil. |37| Additionally, in August 2012, U.S. Trade Representative Kirk announced that the United States and Cambodia have agreed to begin exploratory talks on a possible BIT. |38|

Table 1. United States Bilateral Investment Treaties

(As of September 2012)

Source: CRS with data from USTR and the State Department.

Note: The symbol "*" indicates that treaty has not entered into force.The United States has entered into 14 FTAs with 20 countries, the majority of which include "BIT-like" investment chapters with "core" investor protections (see Table 2). For example, the most recent FTAs to be implemented and entered into force (Peru, Colombia, South Korea, and Panama) contain investment provisions comparable to the benefits and protections provided under BITs. The investment chapter of the U.S.-Australia FTA is distinct from those of the other U.S. FTAs in that it lacks provisions on investor-state dispute settlement. |39| More broadly, U.S. FTAs also reflect trade negotiating objectives established by Congress in 2002 as part of trade promotion authority (TPA) legislation, which includes language on investment protection. |40|

Foreign investment is a priority issue in the ongoing Trans-Pacific Partnership (TPP) free trade agreement negotiation. The United States has existing FTAs with six of the TPP participants (Australia, Canada, Chile, Mexico, Peru, and Singapore), which include investment provisions. The United States does not have BITs with the four other current TPP participants (Brunei, Malaysia, New Zealand, and Vietnam). The United States and Vietnam launched BIT negotiations in June 2008, but it is unclear if they will continue, given their participation in the larger TPP negotiation. |41| Investment will likely be a priority issue during negotiations between the United States and Europe on a Transatlantic Trade and Investment Partnership (TTIP). A February 2013 report, endorsed by President Obama and European Commission President Jose Manuel Barroso, on the proposed TTIP, recommended that an agreement should "include investment liberalization and protection provisions based on the highest levels of liberalization and highest standards of protection that both sides have negotiated to date." |42|

Table 2. U.S. Free Trade Agreements (FTAs) in Effect: Investment Provisions

Source: CRS with data from USTR and CRS Report RL3I356, Free Trade Agreements: Impact on U.S. Trade and Implications for U.S. Trade Policy, by William H. Cooper.

Notes: The U.S.-Canada FTA (implemented on September 28, 1988, and entered into force on January I, 1989) was suspended with the implementation of NAFTA.In addition to BITs and FTAs, the United States has advanced investment protection through other mechanisms. For example, in April 2012, the United States and the European Union reaffirmed their joint commitment to open, transparent and non-discriminatory investment policies, embodied in a joint "Statement on Shared Principles for International Investment." |43| The transatlantic principles formed the basis for U.S. bilateral agreements with Morocco (December 2012) and Jordan (January 2013) on investment principles. |44|

Congress plays an active role in developing and implementing the U.S. policy on direct investment, including through setting investment negotiating objectives in trade promotion authority; Senate ratification of BITs; and approval and enactment of implementing legislation for trade agreements by both the House of Representatives and the Senate. Congress may wish to consider several policy issues as it considers new bilateral investment treaties.

Do U.S. BITs Promote Investment Abroad?

Given U.S. efforts to negotiate investment agreements, a major debate is whether such agreements actually facilitate investment. The presence of investment agreements is one of many factors that might contribute to a company's decision to pursue direct investment abroad. Others include the size and growth of the host country market, labor force, endowment of natural resources, exchange rates, taxes, the level of trade and investment protection, rule of law, political stability, infrastructure, and business facilitation measures. |45|

Several economic studies have looked at the impact of BITs by comparing changes in FDI flows against a variety of independent variables. Many early studies found no significant connection between the presence of a BIT and increased FDI flows. |46| More recent research suggests that, under certain circumstances, signing and ratifying a BIT could lead to increased investment (see text box). However, such empirical analysis may have limitations. One possible shortcoming is that many studies, to date, have used aggregate investment data. The Peterson Institute for International Economics (PIIE), for example, argues that different FDI streams (extractive industries, infrastructure, manufacturing, and services, etc.) have distinct benefits, costs, and policy challenges, and should be analyzed separately. |47|

In any case, the presence of a BIT or FTA provisions on investment and the protections they offer may have a positive effect on the investment climate (see text box). Investors consider the provisions in investment agreements critical to providing the protections necessary to conduct business in foreign markets. For many developing countries, FDI is the largest source of external financing for their economies. Some consider FDI to be critical to fostering rule of law, reducing corruption, building institutions, promoting respect for and protection of private property and contract rights, streamlining administrative and legal procedures, and developing a regulatory environment conducive to capital formation in general and international investment in particular.

Studies on the Impact of BITs on Investment Evidence is mixed on the relationship between the presence of a BIT and FDI, as the following studies indicate.

- A 2005 study by Salacuse and Sullivan looking at U.S. BITs over a 10-year period (1991 -2000) found that for the United States, the existence of a BIT is correlated with around $1 billion in additional FDI per year. The study also suggested that stronger (more investor protective) BITs (such as the U.S. BITs included in the study) were more likely to have a positive impact on FDI than BITs with weaker standards of protection. This finding may also suggest that the recent efforts to recalibrate BIT protections, such as the 2004 and 2012 revisions to the U.S. Model BIT, could reduce the investment promotion effect of BITs. |48|

- In a 2006 study of BITs by OECD countries with developing countries, Tobin and Rose-Ackerman found that BITs have a positive impact on FDI flows to developing countries, but the impact is highly dependent on the political and economic environment of the host country. The positive impact of signing a BIT is strengthened as a country's economy or political environment for investment improves. |49|

- A 2005 study by Neumayer and Spess that examined BITs between 119 countries during I970-200I found that developing countries that sign BITs with developed countries receive more FDI than countries that do not pursue these treaties. |50| Contradicting Tobin and Rose-Ackerman, however, this study finds that BITs may substitute for good domestic institutional policies.

- A 2007 study by Franck suggests that the inclusion of binding investor-state dispute resolution in BITs indirectly facilitates FDI by promoting the rule of law and economic development. |51|

- A 2012 study by Burger, Busse, Nunnenkamp, and Roy compares the relative effectiveness of concluding a BIT and incorporating investment provisions in a regional trade agreement. The authors find that investors responded positively to a BIT regardless of the strength of the dispute resolution measures or market access provisions. On the other hand, trade agreements with similar provisions had no impact on inward FDI and in some cases had a negative impact if there was a substitution of home-country exports for FDI. |52|

Negotiating Priorities for the U.S. Investment Policy Agenda

U.S. investment negotiations can help to advance U.S. trade, foreign policy, and development objectives. A major issue for Congress is the Administration's prioritization of countries and policy objectives in U.S. investment negotiations. Congress could press the Administration through legislation and oversight to pursue certain investment negotiation directions. For example, Congress will likely debate and actively consider negotiating objectives and priorities in legislation to renew TPA. Congress could also express its preferences through other legislative vehicles, for example, through oversight of current free trade negotiations, such as TPP.

One possible area of focus is prioritizing certain countries or regions in BIT negotiations. For instance, the United States could intensify and conclude previously launched BIT negotiations, such as those with India and China. Negotiations with these countries could yield substantial economic benefit to U.S. investors, although they could raise questions about outsourcing.

A second area of focus could be to launch investment negotiations with new trading partners that represent key U.S. trade, foreign policy, and development priorities. For example:

- Sub-Saharan Africa (SSA): Some U.S. policymakers have expressed increasing interest in expanding U.S. economic relations with SSA countries. |53| BITs could serve as one of the policy tools for expanding these relations, and could ultimately pave the way for bilateral or regional FTAs.

- Middle East and North Africa (MENA): In light of the ongoing political transitions taking place in the MENA, U.S. policymakers have been engaged in efforts to support democratic transitions and economic development in these countries. |54| U.S. BITs with countries in the region could help to promote economic development, support political reform, and encourage good governance and the rule of law. Such efforts could help lay the groundwork for possible future U.S. FTAs with MENA countries individually or with the region in the long term.

- Latin America: The region could constitute a bigger priority for U.S. policymakers in response to increased hostility toward foreign investment in the region. Increased state-led intervention in several growing emerging economies in the region; the associated rise of "resource" expropriation activities in certain economies; and increased resistance to investor-state arbitration through ICSID will likely challenge U.S. investors in the region. Several countries including Argentina, Ecuador and Venezuela have withdrawn from ICSID and are seeking to withdraw their BITs, including those with the United States. Some have argued that the United States should seek a BIT with Brazil, the region's largest economy and a major commodities exporter. More so than other South American countries, Brazil has shunned investment treaties completely and despite signing several in the 1990s, there are no agreements currently in force.

A third area of focus could be the "renegotiation" of existing U.S. BITs. Although the United States typically does not renegotiate BITs following the release of a new model BIT, Congress could consider whether "updates" may be needed in certain cases. Possible candidates for updates could include the U.S. BITs with Egypt and Tunisia, both signed more than two decades ago. Since these agreements came into effect, the 2004 and 2012 U.S. model BIT templates have made revisions in multiple areas, responding to the changing nature of the global investment landscape. For example, the U.S. BIT with Egypt does not include many services (such as telecommunications, banking, and insurance) within the scope of "covered investments." |55|

In establishing such negotiating priorities, Congress could examine the criteria which the Administration uses to determine which countries to select to approach for negotiating a BIT. In turn, Congress also could identify what its negotiation priorities are or should be. Factors for consideration may include the potential economic benefit to the United States, the willingness of countries to negotiate, the feasibility of such negotiations, and the foreign policy and development benefits that may be served. The conclusion of high-standard investment agreements with such countries may prove difficult because of divergent views of certain investment-related issues, such as labor and environmental protections.

A fourth area for future consideration is whether there should be renewed efforts to negotiate a more comprehensive multilateral framework on investment at the WTO |56| or to establish an appellate body for ICSID (or other) investor-state arbitration. |57|

[Source: By Shayerah Ilias Akhtar and Martin A. Weiss, Congressional Research Service, R43052, Washington, 29Apr13. Shayerah Ilias Akhtar and Martin A. Weiss are Specialists in International Trade and Finance]

Notes:

1. The United States defines direct investment as the ownership of at least 10% of the voting securities of an incorporated business enterprise or the equivalent interest in an unincorporated business enterprise; 15 C.F.R. § 806.15(a)(1). [Back]

2. United Nations Conference on Trade and Development (UNCTAD), World Investment Report 2012: Towards a New Generation of Investment Policies. [Back]

3. The White House, "Statement by the President on United States Commitment to Open Investment Policy," press release, June 20, 2011. [Back]

4. Office of the U.S. Trade Representative (USTR), Bilateral Investment Treaties, http://www.ustr.gov/trade-agreements/bilateral-investment-treaties. [Back]

5. For more information on TPA, see CRS Report RL33743, Trade Promotion Authority (TPA) and the Role of Congress in Trade Policy, by J. F. Hornbeck and William H. Cooper. [Back]

6. For a detailed discussion of trends in international investment flows, see CRS Report RS21118, U.S. Direct Investment Abroad: Trends and Current Issues, by James K. Jackson, and CRS Report RS21857, Foreign Direct Investment in the United States: An Economic Analysis, by James K. Jackson. [Back]

7. For a history of past efforts to create a multilateral investment treaty, see Stephen W. Schill, The Multilateralization of International Investment Law (Cambridge: Cambridge University Press, 2009), p. 31-60. [Back]

8. Jeswald Salacuse, The Law of Investment Treaties (Oxford: Oxford University Press, 2010), p. 104-108. [Back]

9. Meredith Broadbent and Robbins Pancake, Reinvigorating the U.S. Bilateral Investment Treaty Program: A Tool to Promote Trade and Economic Development, Center for Strategic & International Studies (CSIS), June 2012, p. 3. [Back]

10. For more information on the treatment of investment in the WTO, see Phillipe Gugler and Vladimir Tomsik, A Comparison of the Provisions Affecting Investment in the Existing WTO Obligations, Swiss National Center of Competence in Research, August 2006. [Back]

11. National treatment means that imported and locally produced goods should be treated equally--at least after the foreign goods have entered the market. Most-favored nation (MFN) status means equal--rather than exclusively favorable--treatment. For more information, see CRS Report RL31558, Normal-Trade-Relations (Most-Favored-Nation) Policy of the United States, by Vladimir N. Pregelj. [Back]

12. Performance requirements are market distorting and discriminatory conditions that a country imposes on foreign firms. Trade economists identify two main types of performance requirements: mandatory performance requirements and incentive-based performance requirements. Mandatory performance requirements are conditions or requirements that are imposed at the pre- and/or post-establishment phases of an investment. Incentive-based performance requirements are conditions that an investor must meet to secure a government subsidy or incentive. [Back]

13. On the provisions of bilateral investment treaties, see Jeswald Salacuse, The Law of Investment Treaties (Oxford: Oxford University Press, 2010). [Back]

14. Tom Ginsburg, "International Substitutes for Domestic Institutions: Bilateral Investment Treaties and Governance," International Review of Law and Economics, Vol. 25, 2005. [Back]

15. James Salacuse and Nicholas Sullivan, "Do BITs Really Work? An Evaluation of Bilateral Investment Treaties," Harvard International Law Journal, Vol. 46, Issue 1, 2005, pg. 68. [Back]

16. UNCTAD, "Bilateral Investment Treaties Quintupled During the 1990s," press release, TAD/INF/PR/077, December 15, 2000. [Back]

17. UNCTAD, 2012 World Investment Report. [Back]

18. UNCTAD, "Global Investment Trends Monitor 11, January 23, 2013." See also, CRS Report RL33984, Foreign Direct Investment: Current Issues, by James K. Jackson. [Back]

19. Suzanne A. Spears, "The Quest for Policy Space in a New Generation of International Investment Agreements," Journal of International Economic Law, vol. 16, no. 1, 2010. [Back]

20. CRS Report R42694, The Trans-Pacific Partnership Negotiations and Issues for Congress, coordinated by Ian F. Fergusson. [Back]

21. "Vattenfall in Nuclear Spat with Gernamy," The Local: Sweden's News in English, December 22, 2012. [Back]

22. "Argentina: Repsol Files YPF Nationalisation Complaint," BBC News, December 3, 2012. [Back]

23. CRS Report RL31638, Foreign Investor Protection Under NAFTA Chapter 11, by Robert Meltz. [Back]

24. Treaty Between the United States of America and the Oriental Republic of Uruguay Concerning the Encouraging and Reciprocal Protection of Investment. Available at http://www.ustr.gov/assets/World_Regions/Americas/South_America/Uruguay_BIT/asset_upload_ffile582_6728.pdf. [Back]

25. See CRS Report RL31638, Foreign Investor Protection Under NAFTA Chapter 11, by Robert Meltz. [Back]

26. Trade Act of 2002 (P.L. 107-210). [Back]

27. Murphy, Sean D. "New U.S. Model Bilateral Investment Treaty," United States Practice in International Law 20022004. [Back]

28. Report of the Subcommittee on Investment Regarding the Draft Model Bilateral Investment Treaty, presented to the Advisory Committee on International Economic Policy, January 30, 2004. Available at http://www.ciel.org/Publications/BIT_Subcmte_Jan3004.pdf. [Back]

29. Gilbert Gagne and Jean-Frederic Morin, "The Evolving American Policy on Investment Protection: Evidence From Recent FTAs and the 2004 Model BIT," Journal of International Economic Law, vol. 9, no. 2 (2006). [Back]

30. U.S. Department of State, "Model Bilateral Investment Treaty," press release, April 20, 2012. [Back]

31. Report of the Advisory Committee on International Economic Policy Regarding the Model Bilateral Investment Treaty, presented to the Department of State, September 30, 2009. [Back]

32. U.S. Department of State, "Model Bilateral Investment Treaty," press release, April 20, 2012. [Back]

34. For example, see Karl F. Inderfurth and Meredith Broadbent, The United States and India: BIT and Beyond, Center for Strategic & International Studies (CSIS), June 21, 2012. [Back]

35. Emergency Committee for American Trade (ECTA), ECAT 2012 Agenda. [Back]

36. USTR, 2012 Trade Policy Agenda and 2011 Annual Report, p. 6; USTR, "Joint Statement on the United States-East African Community Trade and Investment Partnership," press release, June 15, 2012. [Back]

37. Department of State, "Remarks at the Business Leaders' Lunch," press release, April 16, 2012. [Back]

38. USTR, "United States, Cambodia to Explore Possibility of Investment Treaty," press release, August 31, 2012. [Back]

39. During the negotiations, Australia argued that including investor-state provisions were unnecessary because U.S. and Australian legal traditions regarding investment were very similar, and U.S. investors, they argued, would receive fair treatment in Australian courts. The final agreement does, however, contain a provision that will allow for the establishment of an investor-state dispute mechanism, if changed circumstances warrant it. For more information, see CRS Report RL32375, The U.S.-Australia Free Trade Agreement: Provisions and Implications, by William H. Cooper. [Back]

40. Trade Promotion Authority (TPA), previously referred to as "fast-track" authority, is the authority granted by Congress to the President to facilitate the negotiation of international trade agreements. When TPA is provided by Congress, the President can enter into certain reciprocal trade agreements and have their implementing bills considered under expedited legislative procedures, provided the President observes certain statutory obligations. For additional information, see CRS Report RL33743, Trade Promotion Authority (TPA) and the Role of Congress in Trade Policy, by J. F. Hornbeck and William H. Cooper. [Back]

41. For additional information on the Trans-Pacific Partnership negotiations, see CRS Report R42694, The Trans-Pacific Partnership Negotiations and Issues for Congress, coordinated by Ian F. Fergusson. [Back]

42. Final Report of the EU-U.S. High Level Working Group on Jobs and Growth, February 11, 2013. [Back]

43. Statement of the European Union and the United States on Shared Principles for International Investment. [Back]

44. USTR, "United States and Morocco Reach Agreement on Trade Facilitation, Joint Investment Principles and Joint Information and Communication Technology (ICT) Principles," press release, December 7, 2012. USTR, "U.S. Trade Representative Ron Kirk Announces Agreements Between the United States and Jordan to Boost Investment and Economic Growth, Enhance Labor Cooperation," press release, January 28, 2013. Electronic communication with USTR official, January 30, 2013. [Back]

45. CRS Report RL33984, Foreign Direct Investment: Current Issues, by James K. Jackson. Meredith Broadbent and Robbins Pancake, Reinvigorating the U.S. Bilateral Investment Treaty Program: A Tool to Promote Trade and Economic Development, CSIS, June 2012, p. 8. [Back]

46. For example, Mary Hallward-Dreimeier, "Do Bilateral Investment Treaties Attract FDI? Only a Bit ... and They Could Bite," World Bank Policy Research Working Paper 3121, June 2003, and Susan Rose-Ackerman and Jennifer Tobin, "Foreign Direct Investment and the Business Environment in Developing Countries: The Impact of Bilateral Investment Treaties," Working Paper, Yale Center for Law, Economics, and Public Policy 2005. [Back]

47. Theodore H. Moran and Lars Thunell, Foreign Direct Investment and Development: Launching a Second Generation of Policy Research, Peterson Institute for International Economics, Washington, DC, June 1, 2011. [Back]

48. Jeswald W. Salacuse and Nicholas P. Sullivan, "Do BITs Really Work?: An Evaluation of Bilateral Investment Treaties and Their Grand Bargain," Harvard International Law Journal, vol. 46, no. 1 (Winter 2005). [Back]

49. Jennifer L. Tobin and Susan Rose-Ackerman, "When BITS have some bite: The political-economic environment for bilateral investment treaties," The Review of International Organizations, vol. 6, no. 1 (March 2011). This study was originally published in November 2006 as a working paper. [Back]

50. Eric Neumayer and Laura Spess, "Do bilateral investment treaties increase foreign direct investment to developing countries?," World Development, October 2005. [Back]

51. Susan D. Franck, "Foreign Direct Investment, Investment Treaty Arbitration, and the Rule of Law," Global Business & Development Law Journal, vol. 19 (2007). [Back]

52. Axel Berger, Matthias Busse, Peter Nunnenkamp and Martin Roy, Attracting FDI through BITs and RTAs: Does treaty content matter, Vale Columbia Center on Sustainable International Investment , No. 75, New York, NY, July 30, 2012. [Back]

53. See The White House, U.S. Strategy Toward Sub-Saharan Africa, June 2012. [Back]

54. Office of the U.S. Trade Representative (USTR), "Trade and Investment Engagement with the Middle East and North Africa," press release, September 15, 2011. [Back]

55. Meredith Broadbent and Robbins Pancake, Reinvigorating the U.S. Bilateral Investment Treaty Program: A Tool to Promote Trade and Economic Development, CSIS, June 2012, p. 4. [Back]

56. David Collins, "A New Role for the WTO in International Investment Law: Public Interest in the Post-Neoliberal Period," Connecticutt Journal of International Law, vol. 25, no. 1 (2009). [Back]

57. Debra P. Steger, "Enhancing the Legitimacy of International Investment Law by Establishing an Appellate Mechanism," in Improving International Investment Agreements (New York: Routledge, 2013), Armand de Mestrel & Celine Levesque (eds), pp. 257-264. [Back]

| This document has been published on 08May13 by the Equipo Nizkor and Derechos Human Rights. In accordance with Title 17 U.S.C. Section 107, this material is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. |