| Information |  | |

Derechos | Equipo Nizkor

| ||

| Information |  | |

Derechos | Equipo Nizkor

| ||

18Nov13

Mexico's Oil and Gas Sector: Background, Reform Efforts, and Implications for the United States

Contents

Introduction

Pemex: A Brief History

Current Efforts to Reform Pemex

Mexico's Energy ResourcesOil: Attracting a lot of Interest

Natural Gas: More Needed

Unconventional Oil and Natural Gas Opportunities

Refining: Limited Capacity and in Need of ModernizationEnergy: a Central Component of U.S.-Mexico Trade

Mexico Still a Top U.S. Oil Supplier

Trade in Natural GasAreas of U.S.-Mexico Energy Cooperation

Bilateral Framework on Clean Energy and Climate Change

Proposed United States-Mexico Trans-Boundary Hydrocarbons AgreementImpact on the U.S. Oil and Natural Gas Sectors

Trade, Investment, and the Proposed Trans-Pacific Partnership Agreement

Mexico's Economic DevelopmentFigures

Figure 1. Mexican Oil Production, Consumption, and Exports

Figure 2. Mexico Energy Infrastructure

Figure 3. U.S./Mexico Oil & Natural Gas Activity Around the Gulf of Mexico

Figure 4. Mexican Natural Gas Production, Consumption, and Imports

Figure 5. Top 5 Imports from MexicoTables

Table 1. U.S. Crude Petroleum Oil Imports in 2012

Summary

The future of oil and natural gas production in Mexico is of importance for both Mexico's economic growth, as well as for U.S. energy security, a key congressional interest. Mexico has consistently been a top crude oil supplier to the United States. However, its oil production has declined dramatically in recent years. The Mexican Congress is in the midst of considering historic reforms to open Mexico's oil and natural gas sector to international companies that could potentially help Mexico reverse those declines. If adopted, these reforms could create significant investment opportunities for U.S. companies, increase the already robust U.S.-Mexican energy trade, and bolster North American competitiveness.

Mexico's state oil company, Petroleos Mexicanos (Pemex), established in 1938 as the world's first major national oil company, remains an important source of government revenue even as it is struggling to counter the country's declining oil production and reserves. Experts have long urged the Mexican government to reduce the heavy fiscal burden on Pemex and reform the constitution to enable Pemex to partner with international companies that have the experience and capital required for exploring Mexico's large deep water and shale resources. Numerous stakeholders in Mexico remain concerned, however, that increasing private involvement in Pemex could threaten Mexico's traditional control over its natural resources.

President Enrique Peña Nieto of the nationalistic Institutional Revolutionary Party (PRI) won the Mexican presidency on December 1, 2012 after 12 years of rule by the conservative National Action Party (PAN). Even though Pena Nieto stood for the PRI, the party that originally nationalized the oil industry, he campaigned on an economic platform that prioritized allowing Pemex to form joint ventures with private companies. President Pena Nieto introduced an energy reform proposal dealing with the hydrocarbons and electricity sectors in August 2013 and is urging the Mexican Congress to enact those reforms during the current legislative session that concludes in mid-December 2013. With support from the PAN and other small parties, the prospects for reforming Pemex appear better now than in the past.

The U.S. Congress has legislative and oversight interests in examining the potential implications of Mexico's oil and natural gas reforms on U.S. hydrocarbons imports and exports, bilateral trade and investment, and economic conditions in Mexico (a top trade partner). The U.S. House and Senate have passed legislation (H.R. 1613 and S. 812) related to implementing a U.S.-Mexico Transboundary Hydrocarbons agreement that would facilitate joint development of oil and natural gas in part of the Gulf of Mexico. Other legislation has been introduced dealing with U.S. approval processes for North American energy infrastructure, including oil and gas pipelines (H.R. 3301). The North American Free Trade Agreement (NAFTA) excluded private investment in Mexico's energy sector, but it is possible that these issues could be addressed in the ongoing negotiations for the proposed Trans Pacific Partnership (TPP) agreement. Regardless, an opening of Mexico's oil and natural gas sector could expand U.S.-Mexico energy trade and provide opportunities for U.S. companies and investors involved in the hydrocarbons sector, as well as infrastructure and other oil field services. If these reforms accelerate growth and investment in Mexico (as the government has promised), they could benefit North American competitiveness.

The United States has a strong economic interest in ensuring energy security, bolstering exports, and reducing barriers to U.S. trade and investment. The United States also has a national security and an economic interest in ensuring that Mexico, a key ally and top trade partner with which the United States shares a nearly 2,000 mile border, is economically vibrant and politically stable. |1| U.S.-Mexico energy trade and cooperation has come to play an important role in achieving those goals. U.S. policy makers are therefore closely monitoring the outcome of reforms under consideration in the Mexican Congress that would allow Mexico's struggling state oil company, Petroleos Mexicanos (Pemex), to partner with international companies to boost production.

In recent years, Congress has convened a number of hearings on Latin American energy issues and, more specifically, U.S.-Mexico energy issues. During the 113th Congress, congressional consideration has focused on legislation (H.R. 1613 and S. 812) related to implementing a U.S.Mexico Transboundary Hydrocarbons agreement that would provide a legal framework for joint development of oil and natural gas resources in part of the Gulf of Mexico. |2| While joint development in the transboundary area could be a step forward for bilateral energy cooperation, Congress arguably has a greater oversight and potentially legislative interest in increasing U.S. trade and investment in Mexico's broader hydrocarbons sector and U.S. natural gas and refined petroleum products exports to Mexico.

In August 2013, President Enrique Pena Nieto of the Institutional Revolutionary Party (PRI) introduced a constitutional reform proposal that would, among other things, allow Pemex to form partnerships with international companies. The Pena Nieto Administration is urging the Mexican Congress to enact his energy reform proposals, along with related fiscal measures to reduce Pemex's tax burden, during the current legislative session that concludes in December 2013. With support from the conservative National Action Party (PAN), whose past efforts to reform Pemex were watered down by the PRI, and other small parties, the prospects for reform appear to be high. The leftist Party of the Democratic Revolution (PRD) opposes the PRI and PAN proposals, maintaining that private involvement in Pemex could threaten Mexico's control over its natural resources. They have blocked past efforts to muster the two-thirds vote in the Mexican Congress that would be necessary to enact constitutional amendments to reform Pemex.

This report provides an overview of Pemex and the content and prospects for the energy reforms currently under consideration in the Mexican Congress before discussing specific issues facing Mexico's oil and gas industry. It then examines the U.S.-Mexico energy relationship through the lenses of trade and energy cooperation. It concludes by suggesting several oversight issues for Congress related to what the enactment of energy reform in Mexico might portend for the U.S. energy matrix, U.S. trade and investment in Mexico's hydrocarbons industry, and Mexico's economic development.

Foreign investment in Mexico's oil industry has had a tumultuous history. |3| After oil was discovered in Mexico at the turn of the 20th century, foreign investors - primarily from Britain and the United States - played a significant role in helping the country become the world's second largest oil producer by the early 1920s. However, political unrest during and after Mexico's bloody revolution (1910-1920) and the country's 1917 constitution, which established national ownership of all hydrocarbons resources, caused investment in Mexico's oil and natural gas sectors to gradually decline. By the 1930s, reduced foreign investment had resulted in dramatic declines in production levels, and fraught relations between U.S. oil companies and successive post-revolutionary presidents had damaged U.S.-Mexican relations. Tensions culminated in President Lazaro Cardenas' historic 1938 decision to abandon efforts to mediate a bitter labor dispute between Mexican oil workers and foreign companies and instead follow through on his threat to expropriate all U.S. and other foreign oil assets in Mexico.

Upon its creation in 1938, Pemex became a symbol of national pride and a rallying point around which Cardenas and what became the PRI united a disparate Mexican society against foreign intervention. Oil remains deeply tied to Mexican nationalism. Nevertheless, Pemex continued to pursue service contracts with some U.S. oil companies until the practice was definitively outlawed by a 1958 regulatory law implementing Article 27 of the constitution. |4| Since that time, Pemex has retained a monopoly over Mexico's oil and natural gas sector and the Mexican government, namely the Finance Ministry, has kept tight control over the companies' finances and management.

Seventy-five years since its founding, Pemex is facing significant challenges. Pemex had its heyday in the late 1970s following the discovery of the huge shallow water Cantarell oil field, but the company's long-term performance has been hindered by a number of factors. For years, Pemex sustained itself on the revenue produced from its relatively easy-to-exploit shallow water fields without investing the capital necessary to replace those reserves with new fields or even maintain its infrastructure. Pemex has a high percentage of losses, low worker productivity, and facilities that are in significant need of repair; 37 people were killed in January 2013 after an explosion occurred at one of the company's offices in Mexico City. |5| In part because of the Mexican government's heavy tax demands, Pemex has operated at a loss since 1998 and significantly increased its debt burden. Until recently, the government had also prevented the company from reinvesting its profits into maintenance and new exploration. |6| Some analysts argue that Pemex's pension liabilities, negotiated by the company's powerful and, for some observers, corrupt workers union, have become an unsustainable drain on its finances. |7| Pemex has also recently been losing hundreds of millions of dollars a year due to criminal groups illegally tapping into its pipelines. |8| Pemex's inability to partner with other companies arguably inhibited it from benefitting from new expertise and techniques, particularly in deep water drilling where significant resources may be located.

Current Efforts to Reform Pemex

Upon his inauguration, President Pena Nieto announced a reformist agenda aimed at bolstering Mexico's competitiveness. He also concluded a "Pact for Mexico" agreement with the PAN and PRD to develop legislation to enact that agenda that has thus far facilitated the passage of historic financial, education, telecommunications, and most recently, fiscal reforms. Enacting energy reform is now arguably the top legislative priority for President Pena Nieto. As with the other constitutional reforms that have been enacted thus far in 2013, the energy reforms that Pena Nieto has proposed would require a two-thirds vote to amend the Mexican constitution.

The Pena Nieto Administration's constitutional reform proposal on energy |9| would remove hydrocarbons from the list of strategic sectors that can only be developed by the government and allow Pemex to form "profit-sharing" partnerships with international companies in exploration and production. It would also permit those companies to explore and produce on their own. The reform would also allow Pemex to sign agreements with private companies for transporting oil and gas, refining, and producing petrochemicals. In secondary legislation, the President pledged to introduce reforms to give the company budget autonomy, improve its transparency, and change its fiscal structure, among other measures. Pena Nieto also proposed separate fiscal reforms to lower the tax burden on Pemex (possibly by as much as 10%), but the fiscal package recently enacted by the Mexican Congress does not appear to further that goal.

The PAN has put forward deeper reforms than the PRI that would permit private concessions in upstream and downstream |10| operations and production-sharing agreements between Pemex and private companies. Former PAN President Felipe Calderon sought to enact far-reaching energy reforms in 2008, but his proposal was watered down by the PRI-led Congress. |11| The PAN wants to make sure that the reform also includes a strong regulatory body and sets aside a sovereign wealth fund to support social needs. Some PAN legislators have conditioned their support for energy reforms on the PRI backing political reforms, which are simultaneously being discussed.

Some PAN Senators who opposed the fiscal reforms passed by the PRI with PRD support said they would not vote in favor of energy reform, while others are reportedly negotiating with the PRI to ensure that the energy reform includes the possibility of production-sharing agreements. |12|

The PRD opposes allowing private involvement in Pemex. Instead the PRD proposal focuses on reforming the company while simultaneously granting it greater budget autonomy and a less onerous tax burden. Past and present PRD party leaders have joined forces to oppose the PRI and PAN versions of energy reform. They vigorously oppose any reform that would enable multinational corporations to profit from Mexico's oil wealth, which they believe belongs to the Mexican people.

In September 2013, some energy analysts predicted that the prospects for energy reform being enacted this fall were good since the PAN and the PRI agreed on the need for private involvement in Pemex. |13| Although the path forward for energy reform appears more difficult now than it did then, many investors are still optimistic about the potential for the reforms to be passed by the end of the session in mid-December. |14| Even if that should occur, many details that may be left to be defined in secondary laws will be crucial for attracting oil companies to Mexico. Those include establishing a strong industry regulator, outlining when and how oil and natural gas will be commercialized, and detailing whether or not Mexico will permit companies to book reserves. However, secondary laws only need a simple majority to be passed.

Oil: Attracting a lot of Interest

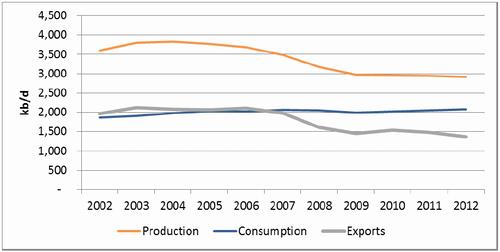

Mexico is the world's 9th largest producer of oil and holds approximately11.4 billion barrels of oil reserves--the 18th largest in the world. |15| Mexico may also have the 5th largest tight oil |16| resources globally, about another 13 billion barrels. |17| With these reserves and their potential natural gas resources, Mexico has the potential to halt its decade-long decline in oil production (see Figure 1) and possibly become self-sufficient in natural gas.

Figure 1. Mexican Oil Production, Consumption, and Exports

2002 - 2012

Source: BP Statistical Review of World Energy 2013, June 2013.

Notes: Units = thousand barrel per day (kb/d).Mexico's oil production has declined by almost 20% over the last decade (see Figure 1) due, in part, to aging and inefficient infrastructure (see Figure 2). Nevertheless, Mexico lags only behind Russia, the United States, China, and Canada as an important non-OPEC oil producer. Most of Mexico's production (75%) is found offshore in the shallow waters of the Bay of Campeche, which is part of the Gulf of Mexico, and concentrated in two fields--Ku-Maloob-Zaap (KMZ) and Cantarell. KMZ production has been on the rise since 2006, reaching almost 867,000 barrels per day (b/d) at the end of 2012, and has replaced part of Cantarell's decline. |18| Cantarell was once one of the largest producing fields in the world, but started having pressure problems in the mid-1990s. |19| Efforts to reverse the decreasing production were successful for a while and the field reached its peak in 2004 at 2.1 million b/d. Since then, the decline has been precipitous and Cantarell produced about 400,000 b/d less in 2012. |20|

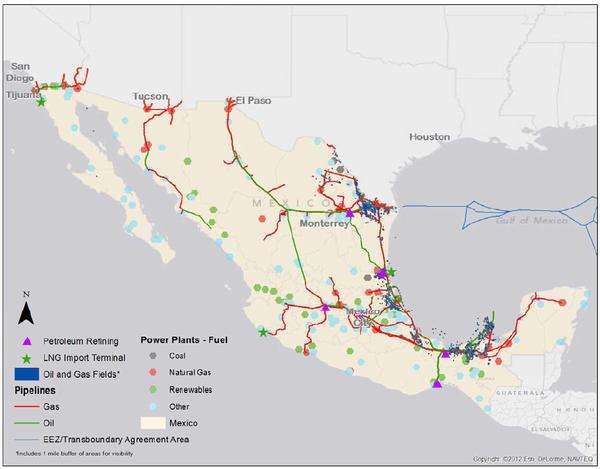

Figure 2. Mexico Energy Infrastructure

Source: Compiled by CRS using data from IHS, Platts, and Esri. Date: September 2013.

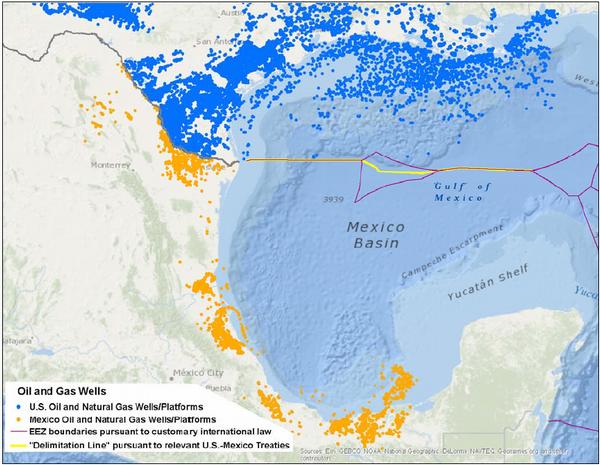

There may also be significant deep water resources in the Gulf of Mexico yet to be discovered. As can be seen below in Error! Reference source not found., Mexico has undertaken very little activity in its portion of the Gulf of Mexico, particularly compared to the United States, in part because Mexico does not yet have the technical capacity to effectively explore or produce its deep water areas. This is one of the reasons that international companies, particularly those with deep water expertise, are excited about the possible reforms in Mexico. Additionally, the U.S.-Mexico Transboundary Agreement (see below) may play an important role in raising Mexico's standards of operation in deep water, which would help international companies should other areas be open to development under future reforms.

Figure 3. U.S./Mexico Oil & Natural Gas Activity Around the Gulf of Mexico

Active Wells and Platforms

Source: Compiled by CRS using data from HSIP Gold 2012 (Platts), IHS 2012 Wells, and Esri.

The possible opening of Mexico's oil and natural gas sector is thus generally viewed positively by international companies. The two primary areas of interest are the Mexican side of the Gulf of Mexico, thought to hold a large amount of hydrocarbons, and Mexico's shale deposits. Several U.S. energy companies involved in shale production are looking across the border into Mexico and hoping that the Pena Nieto government will allow them to explore Mexico's shale potential. Without opening its oil and natural gas sector to international companies that have significant capital and advanced technology, experience, and adopting best industry practices, achieving production increases are less likely for Pemex. Many analysts predict that should Mexico continue on its current path of declining production and inability to tap into its deep water and unconventional oil and natural gas resources, it could become a net oil importer by 2020. |21|

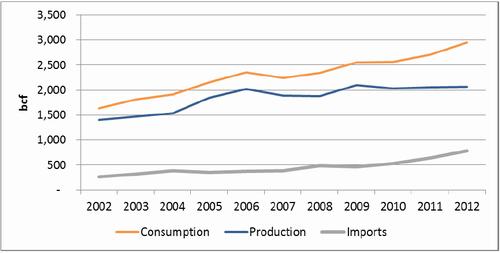

Mexico's natural gas production has risen almost 50% since 2000, but it has not been able to keep up with demand (see Figure 4), which has increased about 80% during that same period. Most of Mexico's natural gas consumption supports its oil operations and national electricity generation. Despite rising domestic production, Mexico's proven gas reserves are on the decline due to underinvestment in exploration. And, although Mexico may have significant unconventional natural gas resources, it is further behind in developing these resources than other countries, such as Canada. Opening up of Mexico's natural gas sector to international companies could help raise natural gas production even faster.

As a consequence of demand rising faster than production, Mexico's imports of natural gas have also been increasing, accounting for about 27% of consumption today compared to less than 10% in 2000. In 2000, Mexico imported 30% of U.S. natural gas exports which accounted for 100% of Mexico's natural gas imports. In 2006, Mexico started importing liquefied natural gas (LNG), from Qatar, Nigeria, and Peru to help meet its growing demand for gas. Mexico has three LNG import terminals, two on the Pacific side and one on the Atlantic.

Figure 4. Mexican Natural Gas Production, Consumption, and Imports

2002 - 2012

Source: BP Statistical Review of World Energy 2013, June 2013.

Notes: Units = billion cubic feet (bcf).As a free trade partner, exports of U.S. natural gas to Mexico are assumed in the public interest by U.S. statute and permitted without delay, which has spurred U.S. natural gas exports to Mexico. As of November 2013, there are four new pipelines and three expansion projects pending before the U.S. Federal Energy Regulatory Commission (FERC) that would increase U.S. natural gas pipeline export capacity by 3.56 bcf/d to 7.38 bcf/d. |22| In 2012, U.S. natural gas exports accounted for approximately 80% of Mexico natural gas imports, and 21% of its natural gas consumption. It would appear that for the immediate future Mexico will likely remain dependent on U.S. supplies of natural gas to meet its growing demand.

Unconventional Oil and Natural Gas Opportunities

One of the areas gathering interest with the possible opening of Mexico's oil and natural gas industry is shale development. The U.S. Energy Information Administration (EIA) has assessed Mexico's tight oil and shale gas resources to be significant (the 4th highest globally). The proximity of some formations in northern Mexico to U.S. developments makes them attractive to some U.S. companies. As an example, the Eagle Ford basin in Texas, one of the fastest growing shale producing areas in the United States, may extend down into Mexico.

Mexico, through Pemex, has already started exploring some of its unconventional formations. A limited number of test wells have been drilled as of November 2013, but Pemex has ambitious plans for scaling up development and production over the next 10 years. However, Mexico will need to undertake reforms to attract outside investment to strengthen regulatory and environmental protection measures, expand pipeline infrastructure, address water management issues, and deal with security concerns. Some of the states in northeastern Mexico where shale formations are located have experienced significant violence in recent years, possibly deterring additional business opportunities. The United States has already been working with Mexico in some of the more technical areas such as resource assessment, environmental protection, and regulatory policies.

Refining: Limited Capacity and in Need of Modernization

Although Mexico is a large exporter of crude oil, it is a net importer of refined petroleum products, such as gasoline and diesel fuel. Mexico does not have enough refining capacity of its own to meet its domestic demand for refined products, nor has it made the investment to process heavy crudes like its Maya crude. Mexico has six refineries with a total capacity of 1.54 million barrels per day, but in recent years has operated below capacity because of operating mishaps. |23| As in many other countries throughout Latin America, Mexico's refineries are in need of major repairs and upgrades and often operate at below their stated capacity. |24| Mishaps and other losses are expected to result in a $7.7 billion loss for the company in 2013. |25| To remedy these problems, Pemex has recently announced plans to build a $3.5 billion expansion of its Tula refinery and is building a new $10 billion refinery to expand Mexico's refining capacity. |26|

Mexico and the United States already have a close relationship in the refining sector. Much of the U.S. Gulf Coast refining capacity is designed to process heavy crudes, which require more sophisticated and expensive technologies than Mexican refineries currently possess. Mexico exports its heavy crude to U.S. refineries on the Gulf Coast, which then sends some of the refined products back to Mexico. Pemex, which operates all of the refineries in Mexico, also owns 50% of a refinery in Texas. The refining relationship between Mexico and the United States could potentially be expanded even further should the reforms fully open up Mexico's downstream (marketing and refining) hydrocarbons market to international companies.

Energy: a Central Component of U.S.-Mexico Trade

The bilateral economic relationship with Mexico is of key interest to the United States because of Mexico's proximity, the high volume of trade with Mexico, and the strong economic ties between the two countries. The United States is, by far, Mexico's leading partner in merchandise trade, while Mexico is the United States' third largest trade partner in total trade after China and Canada. Mexico is the United States' second largest export market after Canada and ranks third as a supplier of U.S. imports. Since the North American Free Trade Agreement (NAFTA) took effect in 1994, the United States and Mexico have become more economically integrated with strong trade and supply chain linkages. Between 1993 and 2012, total U.S. trade with Mexico increased by 506%. |27| In most sectors, NAFTA removed significant trade and investment barriers, ensured basic protections for NAFTA investors, and provided a mechanism for the settlement of disputes between investors and a NAFTA country. The agreement, however, included explicit country-specific exceptions to national treatment and the Mexican government reserved the right to prohibit foreign investment in the production of energy. |28| Despite these exclusions from NAFTA, energy remains a central component of U.S.-Mexico trade, as discussed below.

Mexico Still a Top U.S. Oil Supplier

As previously mentioned, Mexico has been an oil and natural gas producer since the turn of the last century, and has been trading oil and natural gas with the United States at least as long, including after nationalization, averaging around 10% of U.S. imports. Up until 2012, Mexico had been the second largest exporter to the United States behind Canada, but dropped below Saudi Arabia that year. Canada accounted for 23% of U.S. crude oil imports in 2012, followed by Saudi Arabia, which accounted for 17% of the total. In 2012, the value of crude oil imports from Mexico totaled $37.3 billion and accounted for 12% of total U.S. crude oil imports (see Table 1).

Table 1. U.S. Crude Petroleum Oil Imports in 2012

Total in Billions of U.S. Dollars

Country Value % of Total Canada 72.5 23% Saudi Arabia 54.0 17% Mexico 37.3 12% Venezuela 34.2 11% Iraq 19.2 6% Other Countries 98.4 31% Total 315.7 -- Source: Compiled by CRS using USITC Interactive Tariff and Trade DataWeb: HTS number 2709 for crude petroleum oil.

The United States is the destination for approximately 85% of Mexico's oil exports, which arrive via tanker. Although Mexico has an extensive pipeline network that connects major production centers with domestic refineries and export terminals, it does not have any international oil pipeline connections. Exports leave the country via tanker from three Gulf Coast export terminals.

The majority of Mexico's crude oil exports are of the heavy Maya blend (approximately 82% of exports), while the lighter crude oil produced offshore is mostly retained for domestic consumption. Most of Mexico's crude oil exports will likely continue to be exported to the United States because of its close proximity and also because the U.S. Gulf Coast possesses the sophisticated refineries necessary to process the heavier Maya crude oil.

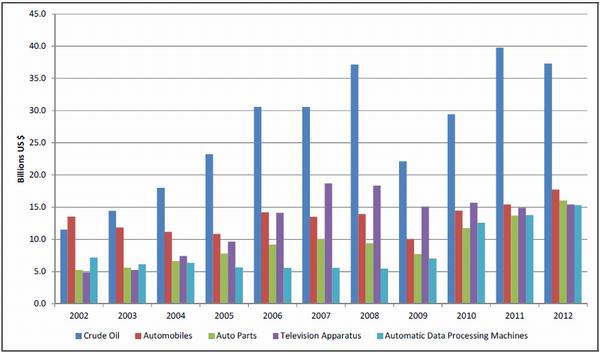

The leading U.S. import item from Mexico is crude petroleum oil. |29| The value of crude oil imports from Mexico in 2012 totaled $37.3 billion, more than two times the value of auto imports ($17.7 billion), the second leading import item. As shown in Figure 5, crude petroleum oil imports from Mexico are considerably higher than other top imports from Mexico, and have become more significant over the past 10 years as a percentage of trade.

Figure 5. Top 5 Imports from Mexico

2002 - 2012

Source: Compiled by CRS using USITC Interactive Tariff and Trade DataWeb at http://dataweb.usitc.gov; HTS4-digit level.

Refined oil exports are the leading U.S. export item to Mexico. In 2012, U.S. refined oil exports to Mexico totaled $20.0 billion, or about 19% of total U.S. refined oil exports. |30| The value of these exports was 34% higher than the value of the second leading export item to Mexico, auto parts ($13.2 billion). After a 31% decrease in 2009, U.S. exports in refined petroleum oil to Mexico increased by 81% in 2010, 70% in 2011, and 3% in 2012.

Mexico ranks first among export markets for U.S. refined oil, accounting for 19% of U.S. refined oil exports. The second leading refined products export market for the United States is Canada, accounting for 10% of U.S. exports, followed by the Netherlands, Chile, and Brazil. Exports to Mexico accounted for almost 60% of the overall growth in total U.S. motor gasoline exports between 2007 and 2011. |31|

Although Mexico is one of the world's largest crude oil exporters, it is a net importer of refined petroleum products. In 2012, Mexico's imports of refined petroleum products from all countries totaled $29.6 billion, up from $29.4 billion in 2011 and $20.3 billion in 2010. |32| Approximately 60% of Mexico's refined petroleum product imports are gasoline and most of the rest are diesel and liquefied petroleum gases (LPG). |33| Although a net importer of refined petroleum products, Mexico's exports of refined petroleum products in 2012 totaled $4.9 billion. Much of these exports were destined for the United States.

The United States has been Mexico's largest supplier of natural gas and Mexico continues to be a growing market for additional U.S. natural gas exports. As previously mentioned, Mexico's natural gas production has failed to keep pace with rising domestic demand making U.S. gas exports an important source of energy. The value of Mexico's natural gas imports has increased from $995.7 million in 2007 to $1.2 billion in 2012. |34|

In 2012, Mexico imported 791 billion cubic feet of natural gas from the United States, an increase of nearly 25% from the levels of 2011. The United States imports a very small amount of natural gas from Mexico. The surplus in natural gas trade with Mexico is expected to widen as recent supply and demand trends in both countries are expected to continue. |35| U.S.-Mexico trade in natural gas is done exclusively via pipeline.

Areas of U.S.-Mexico Energy Cooperation

In addition to the aforementioned burgeoning energy trade between the United States and Mexico, energy cooperation has gradually risen to the top of the U.S.-Mexican political agenda as well. The United States and Mexico have been working on geothermal energy projects since the 1970s, but the possibility of expanding joint efforts to produce renewable energy sources, as well as conventional and unconventional hydrocarbons resources, has just recently entered the bilateral agenda.

Bilateral Framework on Clean Energy and Climate Change

On April 16, 2009, President Obama and then-Mexican President Calderon announced the Bilateral Framework on Clean Energy and Climate Change to jointly develop clean energy sources and encourage investment in climate-friendly technologies. Among others, its goals include enhancing renewable energy, combating climate change, and strengthening the reliability of cross-border electricity grids. Four bilateral meetings have thus far been held to advance the Framework. Since Mexico remains a top U.S. crude oil supplier and many of its untapped resources lie in deep waters in the Gulf of Mexico and in shale formations abutting the U.S. border, the countries want to ensure that Pemex (or other companies) develop those resources in an environmentally responsible way.

The U.S. and Mexican governments share a mutual interest in developing renewable energy sources, particularly those capable of serving rapidly growing population centers along the U.S.Mexico border. As part of that effort, since 2011 the North American Development Bank has provided eleven loans worth $677 million for projects related to wind and solar energy. The U.S. Agency for International Development (USAID) and Mexico have also expanded cooperation on environmental issues with the Mexico Global Climate Change (GCC) Program, a five-year, approximately $70 million program. The program seeks to help Mexico reduce emissions from deforestation, implement a low emissions development plan, and create a system for monitoring greenhouse gas emissions.

Although Mexico is trying to diversify its energy sources, it, like the United States, is likely to continue relying on oil and natural gas from traditional and unconventional (i.e. shale) sources. In the wake of the 2010 Deepwater Horizon spill in the Gulf of Mexico and amid concerns about the impact of hydraulic fracturing of shale oil in the United States, both governments have an interest in ensuring that hydrocarbons resources are developed in an environmentally responsible way. For example, should Pemex partner with U.S. companies in the Gulf, then it could benefit from participation in the Marine Well Containment Company that was created by U.S. companies to deal with spills. Should Pemex pursue contracts with U.S. companies who have years of expertise in hydraulic fracturing, they could complement the environmental and regulatory advice that Mexico is already receiving from the U.S. Departments of State and the Interior.

Proposed United States-Mexico Trans-Boundary Hydrocarbons Agreement |36|

In 2012, the United States and Mexico signed an agreement known as the U.S.-Mexico Transboundary Hydrocarbons Agreement (the Agreement). This proposed Agreement could mark the start of an energy partnership in an area of the Gulf of Mexico that the U.S. Department of the Interior estimates to contain as much as 172 million barrels of oil and 304 billion cubic feet of natural gas. Although it concerns relatively little oil and natural gas, the main purposes of the partnership would be to lift a moratorium on development in that region that has been in effect since 2000 and to allow Pemex and U.S. companies options for jointly developing oil and gas reservoirs, referred to as "transboundary resources," that exist in areas straddling the marine border of both countries. The moratorium is set to expire in January 2014.

The proposed Agreement stems from a series of bilateral treaties originating in the 1970s. Like other diplomatic measures, for the Agreement to take effect, it must be placed before each country's national lawmakers for review. To date, Mexico has completed review and accepted the Agreement. Legislation to approve and implement the proposed Agreement is currently under consideration in the U.S. Congress. Should it be approved by the U.S. government, analysts maintain that these statutory changes would provide Pemex with options to begin forming joint ventures with private companies, whether or not the proposed constitutional reforms are approved. |37| Should the United States not approve the Agreement and the moratorium expires in January 2014, both countries would then be free to exploit oil and gas resources in that area without the certitude anticipated under the framework for joint development options envisioned in the Agreement. Most reports are skeptical that Pemex is in a position to engage in oil and gas activities in that area absent the Agreement.

On June 27, 2012, the House passed H.R. 1613, the Outer Continental Shelf Transboundary Hydrocarbon Agreements Authorization Act (H.Rept. 113-101). This bill would approve and implement the Agreement, but without an explicit exemption for companies operating in accordance with the Agreement from having to comply with extraction reporting requirements found in Section 13(q) of the Securities Exchange Act of 1934. |38| House activity featured signs of a persistent policy divide between "pro-drilling" arguments to accelerate energy production and "anti-drilling" arguments to maintain the moratorium in order to provide time for fiscal, safety, and environmental issues to be addressed.

On October 12, 2013, the Senate passed S. 812, which would allow the Secretary of the Interior to implement the Agreement but not exempt companies from the aforementioned Securities and Exchange Commission disclosure requirements. Since leading pro-drilling groups have reportedly removed their insistence on Congress adopting the House version of this legislation (that includes a waiver on SEC disclosure requirements), House consideration of the Senate version of the bill reportedly could occur without delays related to deliberations on those provisions. |39|

Impact on the U.S. Oil and Natural Gas Sectors

The prospect of Mexico's oil and natural gas sector being opened to foreign investors poses significant changes in the U.S.-Mexico energy relationship that may have advantages and disadvantages for both sides. Reversing Mexico's production decline would add more oil to the global market and enhance U.S. energy security. Having a neighbor who is a growing oil producer to the south, as the United States has to the north with Canada, could provide a reliable supplier for the long term and it would also contribute to North American energy independence. U.S. companies that are able to enter the Mexican upstream sector would benefit from the opening of Mexican resources to foreign investment depending upon the terms of the reforms. This would be true for both the oil and natural gas sectors, but U.S. natural gas producers who export natural gas to Mexico might potentially lose their market.

An expansion of Mexico's refining industry would benefit U.S. companies involved, but may shrink Mexico as an importer of U.S. refined products. Depending upon the type of refineries Mexico builds and the characteristics of additional oil found, U.S. refiners may lose supplies and market share. It should be noted that the global oil market is well integrated and can adapt to changing circumstances, so any net benefit or net loss to U.S. companies is very much in doubt at this stage.

Trade, Investment, and the Proposed Trans-Pacific Partnership Agreement

The United States and Mexico are currently participating in negotiations to conclude a TransPacific Partnership (TPP) Agreement. |40| The TPP, a proposed free trade agreement involving nations on both sides of the Pacific, would likely enhance the links the United States has with Mexico under NAFTA. While NAFTA removed significant investment barriers and ensured basic protections for U.S., Canadian, and Mexican investors in other NAFTA countries, it excluded the energy sector in Mexico, and the Mexican government reserved the right to prohibit foreign investment. |41|

Negotiations for a TPP remain ongoing. With 26 negotiating groups and 29 chapters under discussion, the TPP partners seek to eliminate tariffs and non-tariff barriers to merchandise and services trade and to establish trade rules and disciplines on a wide range of issues, including foreign direct investment. They also strive to create a "21st century agreement" that addresses new and cross-cutting issues presented by an increasingly globalized economy.

If Mexico's restrictions on private investment in the energy sector come up in the market access talks on services and investment, a TPP could have implications for U.S.-Mexico energy relations. Mexico's Energy Secretary, Pedro Joaquin Coldwell, however, has stated that Mexico's energy sector is not part of the TPP talks. |42| U.S. businesses would like to see Mexico remove its restrictions on private investment in the oil and gas sector in the context of the TPP. In its September 2012 comments submitted to the Office of the U.S. Trade Representative, the U.S. Chamber of Commerce stated that Mexico's restrictions on foreign investment in the oil sector contribute to declining production and weaken North American energy security. |43| The Chamber stated in its comments that "TPP is an important opportunity for Mexico to advance investment-related reforms that will allow it to maximize its competitiveness in the 21st century, and U.S. technology and expertise will be an important part of that success." |44|

It is unclear if the state-owned enterprises provisions being negotiated under the proposed TPP would affect Pemex because an agreement has not been reached. According to one journal article, Pemex, one of Mexico's biggest state-owned enterprises (SOEs) would likely fall outside the scope of the reported U.S. proposal to discipline state-owned enterprises in the TPP negotiations. |45| The proposal on SOEs reportedly only applies to SOEs that already compete with private companies and Pemex does not compete with private companies. The U.S. position is not designed to open up sensitive areas where TPP countries do not allow foreign competition or maintain monopolies. |46|

Most experts agree that boosting oil and natural gas production and tapping into Mexico's vast hydrocarbons reserves would likely boost economic growth in Mexico and many agree that Pemex lacks the capital and capacity to accomplish those goals alone. The Pena Nieto government maintains that those goals can best be achieved by a constitutional reform that would enable Pemex to partner with international companies. It asserts that energy reform will result in lower energy prices, higher levels of foreign investment and tax revenues, and more government funds available for social programs that had previously been invested in Pemex-related capital improvement projects ($25 billion in 2012). |47| President Pena Nieto has also predicted that energy reform could create 500,000 new jobs and boost GDP growth by 1% by the end of his term in 2018. The reform also intends to boost backward linkages to Mexico's domestic industries by raising national ownership requirements for firms that feed into the oil supply chain.

Although it is difficult to predict how increasing private participation in Mexico's oil and gas sectors would affect the country's economic development, skeptics see reason to doubt the government's positive predictions. Some argue that multinational companies and large Mexican conglomerates that can serve their needs (for infrastructure or other services) stand more to gain from the energy reform than the Mexican people. |48| Many wonder where the government's job forecasts come from given that most analysts maintain that Pemex is a bloated company with too many employees that would likely shed workers as a result of reform. Others are concerned about the potential for increased oil revenue being mishandled by corrupt Pemex or Mexican government officials rather than invested in strategic ways that will benefit the country as a whole. |49|

During his first year in office, President Pena Nieto has shepherded a number of significant constitutional reforms through the fractious Mexican Congress that had eluded the past two PAN Administrations. Those reforms have the potential to boost economic competitiveness, but implementing them in a meaningful way may prove difficult due to opposition from entrenched interest groups (such as unions and monopolies in various industries). For example, in August and early September massive strikes by teachers' unions presented a significant obstacle to securing legislative approval of three secondary laws needed to implement education reform. The reforms were enacted, but not before their provisions were watered down to placate union officials.

In September, many analysts were predicting that a constitutional reform on energy was headed towards rapid approval by the Mexican Congress since the PRI-PAN coalition had the votes necessary to garner a two-thirds majority. Those predictions have changed, however, as several PAN leaders have pledged to withhold their support for energy reform to express their opposition to recently-enacted fiscal reforms and to force the PRI to back political and electoral reform. In the coming weeks, the PRI and the PAN will have to work to come to a consensus on Pemex reform.

This report will be updated periodically to inform the U.S. Congress on the status of efforts to reform Mexico's oil and gas sector and to analyze how the reforms (or lack thereof) may impact the U.S. oil and natural gas sector, U.S. investment in Mexico's hydrocarbons industry, and Mexico's economic performance.

[Source: By Clare Ribando Seelke (Coordinator), Michael Ratner, M. Angeles Villarreal and Curry L. Hagerty, Congressional Research Service, R43313, Washington D.C., 18Nov13. Clare Ribando Seelke is a Specialist in Latin American Affairs; Michael Ratner is a Specialist in Energy Policy; M. Angeles Villarreal is a Specialist in International Trade and Finance; Curry L. Hagerty is a Specialist in Energy and Natural Resources Policy]

Notes:

1. For background on U.S.-Mexican relations, see: CRS Report R42917, Mexico's Peña Nieto Administration: Priorities and Key Issues in U.S.-Mexican Relations, by Clare Ribando Seelke. [Back]

2. For background, see: CRS Report R43204, Legislation Proposed to Implement the U.S.-Mexico Transboundary Hydrocarbons Agreement, by Curry L. Hagerty and James C. Uzel. [Back]

3. For an overview of Mexico's oil industry from 1901 through the 1970s, see: George Grayson, The Politics of Mexican Oil (Pittsburgh, PA: University of Pittsburgh Press, 1980). [Back]

4. Article 27 of Mexico's 1917 constitution gives the Mexican government exclusive legal authority to exploit, distribute, and process hydrocarbons in the country and states that the government may not, per the regulatory law, grant private concessions for their exploitation. Article 28 establishes petroleum and other hydrocarbons as strategic sectors over which the government (public sector) exerts total control. [Back]

5. Adam Thompson, "Rusty Wheels of Pemex Require Much Oiling," Financial Times, April 3, 2013. [Back]

6. Reforms passed in 2006 allowed Pemex to fund a portion of its capital investments with earnings rather than through the issuance of new debt. Ognen Stojanovski, "Handcuffed: an Assessment of Pemex's Performance and Strategy," in Oil and Governance: State-owned Enterprises and the World Energy Supply, ed. David G. Victor, David R. Hults, and Mark C. Thurber (Cambridge University Press, Cambridge: UK, 2012). [Back]

8. Patrick Corcoran, "Oil Theft is Big Business for Mexican Gangs," InSight Organized Crime in the Americas, March 20, 2012. [Back]

9. The proposal also addressed the electricity sector, but that is not the focus of this report. [Back]

10. Upstream refers to the exploration, development, and production phases of oil and natural gas production. Midstream refers to the transportation of the resource, and downstream refers to the refining and marketing of the resource. Natural gas does not need to be refined, so downstream in that sector relates to the marketing of natural gas. [Back]

11. President Calderon originally proposed measures that would have allowed Pemex to enter into joint ventures with foreign companies in exploration and production, and permitted private companies to build and operate refineries, pipelines, and storage facilities in Mexico. Calderon's proposal prompted strong resistance from the PRD and was significantly watered down by the PRI in the Mexican Congress. Nevertheless, the final legislation brought private sector experts into Pemex's management structure, created an independent board to advise the company, and added greater flexibility to its procurement and investment processes. Most significantly, the 2008 reforms permit Pemex to create incentive-based service contracts with private companies. [Back]

12. Claudia Salazar y Claudia Guerrero, "Crece en AN Rechazo a Reforma Energética," Reforma, October 31, 2013; Juan Montes, "Mexico Seeks Deeper Revamp of Energy Sector," Wall Street Journal, November 5, 2013. [Back]

13. Nader Nazmi, "Mexico: Rooting for Energy Reform," BNP Paribas, August 29, 2013. [Back]

14. Christopher Helman, "Mexico's Enrique Pena Nieto is Leading an Oil Revolution Worth Billions," Forbes, October 31, 2013. [Back]

15. BP Statistical Review of World Energy, June 2013, p. 6. [Back]

16. Tight oil refers to oil that is trapped in impermeable formations, such as shale or sedimentary rocks, and requires artificial fractures to allow the hydrocarbons to flow. [Back]

17. U.S. Energy Information Administration, Technically Recoverable Shale Oil and Shale Gas Resources: An Assessment of 137Shale Formations in 41 Countries Outside the United States, Washington, DC, June 10, 2013, p. 8, http://www.eia.gov/analysis/studies/worldshalegas/. [Back]

18. Laurence Illiff, "Pemex Ups Year-End Oil Output, but is Likely to Miss 2012 Target," Dow Jones Newswires, December 18, 2012. [Back]

19. U.S. Energy Information Administration, Mexico, October 17, 2012, p. 4, http://www.eia.gov/countries/analysisbriefs/Mexico/Mexico.pdf. [Back]

21. See, for example, Shaun Polczer, "Mexico Relies on U.S. as Oil Supply Falls and Gas Demand Rises," Petroleum Economist, September 2013. [Back]

22. According to FERC and EIA data sources. [Back]

23. U.S. Energy Information Administration (EIA), Country Analysis Full Report: Mexico, October 17, 2012. Hereinafter EIA, October 2012. [Back]

24. Justin Jacobs, "Refining Woes in Latin America," Petroleum Economist, October 2013. [Back]

25. "Mexico's Pemex to Incur $7.7 Billion Refining Loss in 2013," Fox News Latino, October 23, 2013. [Back]

26. "Pemex Sees $3.5 Billion Refinery Expansion Adding 40,000 bpd," Reuters, September 23, 2013. [Back]

27. Based on data from the U.S. International Trade Commission (USITC) Interactive Tariff and Trade DataWeb using Harmonized Tariff Schedule (HTS) at the 4-digit level. For more information on NAFTA and its effects on trade, see CRS Report R42965, NAFTA at 20: Overview and Trade Effects, by M. Angeles Villarreal and Ian F. Fergusson. [Back]

28. Chapter 6 of NAFTA applies to energy and basic petrochemicals and reserves investment in most activities in Mexico's energy sector to the Mexican state. Under Annex 602.3, which lists reservations and special provisions in the energy sector, the Mexican state reserves to itself the following strategic activities, including investment in such activities and the provision of services in such activities: exploration and exploitation of crude oil and natural gas; refining or processing of crude oil and natural gas; and production of artificial gas, basic petrochemicals and their pipelines. The annex also reserves foreign trade, transportation, and storage and distribution in the energy sector to the Mexican government. [Back]

29. U.S. International Trade Commission (USITC) trade dataweb, using Harmonized Schedule 2709 for crude petroleum oil. [Back]

30. USITC trade dataweb, using Harmonized Schedule 2710 for refined oil products. [Back]

32. Secretaria de Energia de Mexico, Energy Information System, available at http://www.sener.gob.mx. [Back]

34. Secretaria de Energia de Mexico, http://www.sener.gob.mx. [Back]

36. For background, CRS Report R43204, Legislation Proposed to Implement the U.S.-Mexico Transboundary Hydrocarbons Agreement, by Curry L. Hagerty and James C. Uzel. [Back]

37. CRS interview with Duncan Wood, Director of the Woodrow Wilson International Center for Scholar's Mexico Institute, August 26, 2013. [Back]

39. Ben Geman, "Oil Industry Backs U.S.-Mexico Drilling Bill Without Dodd Frank Waiver," The Hill, October 21, 2013. [Back]

40. For more information on the TPP, see CRS Report R42694, The Trans-Pacific Partnership Negotiations and Issues for Congress, coordinated by Ian F. Fergusson. The twelve countries involved in the Trans-Pacific Partnership (TPP) negotiations include the United States, Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, and Vietnam. [Back]

41. For more information on NAFTA, see CRS Report R42965, NAFTA at 20: Overview and Trade Effects, by M. Angeles Villarreal and Ian F. Fergusson. [Back]

42. Susana Gonzalez, "El sector energetico, fuera del TPP," Política, November 15, 2013. [Back]

43. U.S. Chamber of Commerce, "Statement of the U.S. Chamber of Commerce on the Trans-Pacific Partnership for a Hearing for the Record on Negotiating Objectives With Respect to Mexico's Participation in the Proposed TransPacific Partnership Trade Agreement," September 21, 2012, p. . 5. [Back]

45. Mexican Energy SOEs Likely Fall Outside Scope of U.S. Proposal in TPP," Inside U.S. Trade's World Trade Online, October 11, 2012. [Back]

47. Jose Yuste, "Lozoya: La reforma energetica generaria una inversion billonaria," Dinero en Imagen, September 5, 2013. [Back]

48. "Richard Fausset, "Tons of Thousands Protest Mexican Oil Reforms," Los Angeles Times, September 8, 2013. [Back]

49. Enrique Krauze, "Mexico's Theology of Oil," New York Times, November 1, 2013. [Back]

| This document has been published on 11Dec13 by the Equipo Nizkor and Derechos Human Rights. In accordance with Title 17 U.S.C. Section 107, this material is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. |